While preparing a Will, the person who is making the Will must declare ________ that he is making the Will in his full senses and free from any kind of pressure. Once the testator completes writing the Will, he must the sign the Will very carefully in presence of at least __________independent witnesses.

Which of the following is essential for contract?

A trust involves_______ parties. ___________ is the person who establishes the trust.

Section 45 of the Insurance Act,1938 places a check on the power of insurer to avoid life policy on the ground of innocent misrepresentation after the expiry of ____________ of the policy term

___________ is the submission of a disputed matter to an impartial person.

If a soldier makes a Will in oral form, for what time will it be valid?

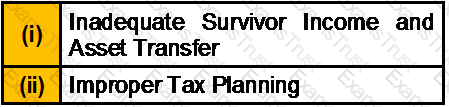

Failure to create an Estate Plan leads to __________

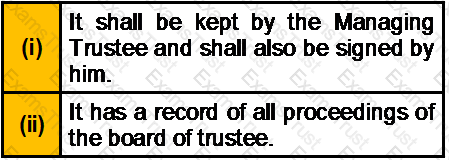

Which of the following statement(s) about Minute Book is/are correct?

There are ______types of Charitable Trust. Out of these, in ________________ the value of assets are protected against inflation as the payouts vary with the asset value.

More than_______ in wealth classifies the person as “Ultra HNI”

The selling/ planning process has __________ steps.

There are four general categories of charitable gifts for donors and non-profits to consider. Out of these________ and ____________ require no contracts, trusts, trustees or special income tax returns. On the other hand, for __________ and _____________most donors and non-profits will need significant level of financial sophistication.

According to__________ of the ‘Registration Act, 1908’ the registration of a Will is not compulsory.

What is Probate?

Which of the following statement(s) about Public Trust is/are correct?

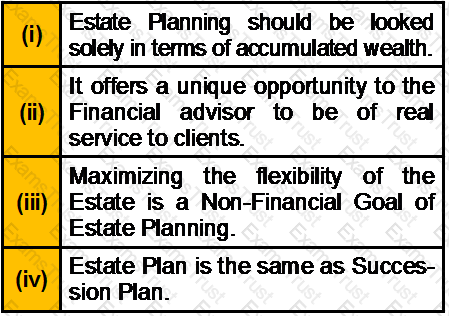

Which of the following statement(s) about Estate Planning is/are correct?

In case one wants to sell his/her business interest __________ and __________ are not appropriate.

Estate planning has_____ phases.

As per the Ancient Hindu Law, there are ____________ Vedas. Scholars have determined that ___________ is the oldest of the Vedas.

Gift received is not taxable in hands of

Which of the following statement(s) about Halal Credit Cards is/are correct?

In case of Loss of Thumb, what is the Percentage of Compensation given (as per Workmen’s Compensation Act)?

In case of non-resident, who is carrying on shipping business, his Indian income shall be presumed to be:

In context to Hindu Marriage Act, 1955 what is “Sapinda Relationship”?

Deduction under section 80QQB is allowed in respect of royalty income to:

Vikrant Juneja gifted his house property to his wife in year 2007. Mrs. Juneja then lets out this house @ Rs. 5000 per month. The income from such house property will be taxable in the hands of:

______________ means a contract in which advance payment is made for good to be delivered later on. ____________ is a special kind of partnership where one partner gives money to the other for investing it in a commercial enterprise.

Which of the following statement(s) about Reverse Mortgage Scheme is/are correct?

Employees Provident Fund is applicable to firms employing over _______________ employees

X owns a piece of land situated in Varanasi (Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-).On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.5 lakh. X does not dispute it. [CII-12-13: 852,11-12: 785,10-11:711]

Which of the following statement(s) about ‘Doctrine of Subrogation’ is/are correct?

Scholarship received by a student was Rs. 2,000 per month. He spends Rs. 15,000 for meeting the cost of education during the year. The treatment for the balance amount Rs. 9,000 is:

In_________ type of arrangement, the mortgagor binds himself to repay the mortgage money on a certain date.

Which of the following is allowed as deduction from net annual value of a property?

Compulsory audit of account is required u/s 44AB of IT, if the total sales/ turnover exceeds _______

As per Muslim Law, if the husband is missing for _________ the wife may file a petition for the dissolution of her marriage. __________ of Dissolution of Muslim Marriages Act provides that that where a wife files petition for divorce under this ground, she is required to give the names and addresses of all persons who would have been the legal heirs of the husband on his death.

_________ means the amount of _________or its equivalent value in money payable under the Muslim law annually by a Muslim during the month of Ramadan to be used for religious or charitable purposes recognized by the Muslim law.

If there default of distribution under the rules of Intestate Succession Act (Singapore) _______________ shall be entitled to whole of the estate.

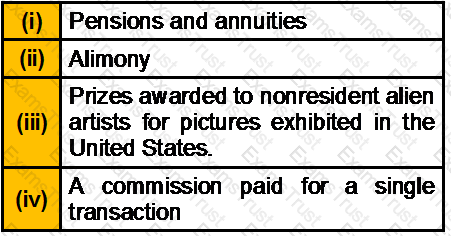

Which of the following income comes under “FDAP Income”?

_____________ is for Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and___________ if for Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding.

In UK, for year 2013-2014 the Income limit for Personal Allowance is _____________ and the Personal Allowance for people born after 5 April 1948 is ___________.

Which of the following statement(s) about Hire Purchase Agreement is/are correct?

The Hire Purchase System is regulated by the Hire Purchase Act ________

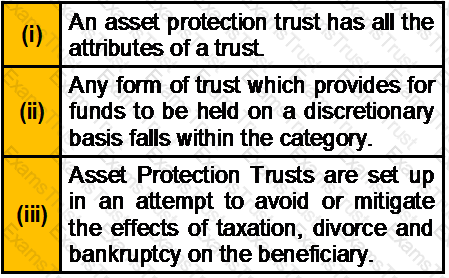

Which of the following statements about Asset Protection trust is/are correct?

In US, the amount of standard deduction is __________ for married individuals filing a separate return.

The Indian Succession Act came into operation on ______________________

Deadline for filing corporate tax return is ______________.

__________________ is spoken rather than dictated or written.

As per the tax structure in the UK, Inheritance Tax will be due at ____________ on the amount over the nil rate band.

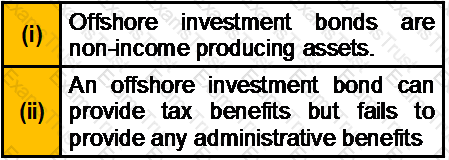

Which of the following statement(s) about Offshore Investment Bond is/are correct?

In India where the Registration Act, 1908 is in force, the Power of Attorney should be authenticated by a______________.

The threshold amount for tax on Net Investment Income is __________in the case of a joint return or surviving spouse, _________in the case of a married individual filing a separate return.

The consideration for the Lease is called _______________

Which of the following statement(s) about Will is/are correct?

______________ of the Transfer Property Act permits the transfer of property only to one or more living persons.

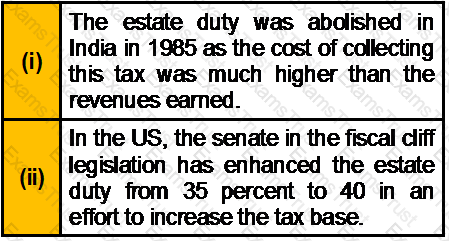

Which of the following statement(s) about Estate duty is/are correct?

________________ is a popular mode of transfer of property to God or Almighty, under the Mohammedean Law.

Which of the following is/are ancillary benefit(s) of Discretionary Family Trust?

Is there any default for not/late filling of wealth tax returns?

Which of the following is/are disadvantage(s) of Living Trust?

______________ of the Income Tax Act provides for the registration of a Charitable Trust. _____________ of the Income Tax Act contains the provision that the profits and gains of the business carried on by a charitable trust would be fully exempt from tax if it is attains the objects of the trust.

What is the full form of DFT?

The Societies Registration Act came into force on _____________________

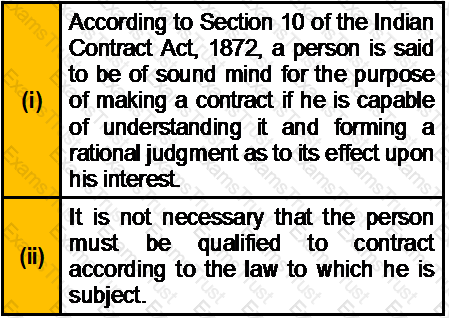

Which of the following statement(s) about Indian Contract Act, 1872 is/are correct?

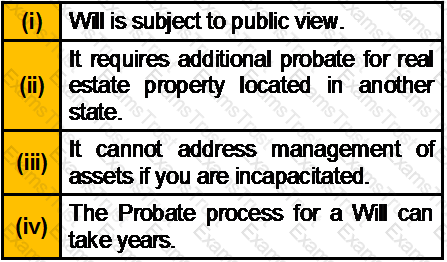

Which of the following is/ are disadvantage(s) of a Will?

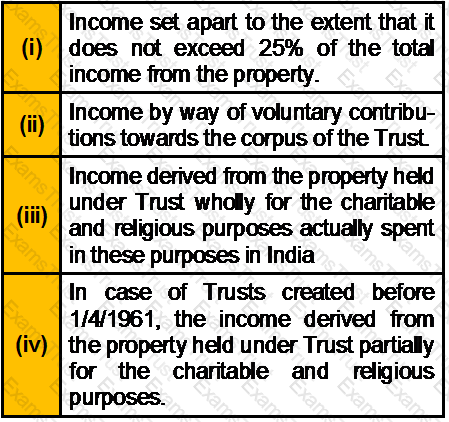

Which of the following incomes are not included for computation of taxable income of a Trust/ Society?

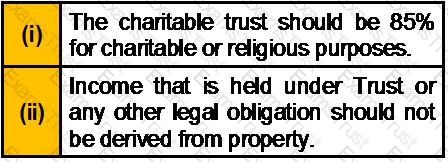

Which of the following is an essential condition for obtaining exemption of the income of a Charitable Trust?

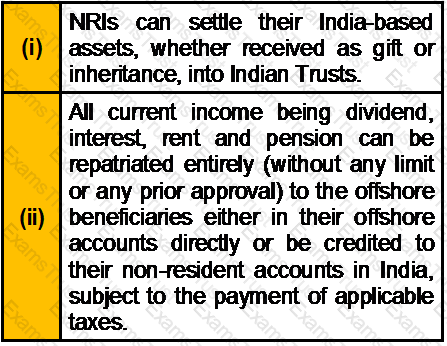

Which of the following statement(s) is/are correct?

Which of the following statement(s) about UTMA is/are correct?

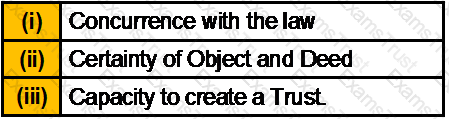

You are an Estate Planner. Mr. Arun Mittal is your client. He is inquisitive to know about Trusts. You explain him that on the basis of intention, Trust is of ____________ types and on the basis of Purpose, Trust is of __________ types. He further asks you that which of these are the requisites for the creation of a Trust out of these

What will be your reply to all of the above questions?