Section B (2 Mark)

An employee who is not resident in the UK will be liable to UK income tax:

Section C (4 Mark)

Read the senario and answer to the question.

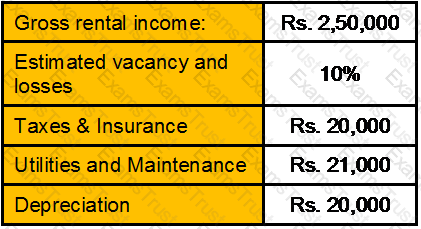

Calculate income from House property for Mr. Keshav for assessment year 2010-11.

Section C (4 Mark)

Suppose Gaurav, an investor, is looking to add to his portfolio and hears about a potential investment through a friend, Hitesh, at a local coffee shop. The conversation goes something like this:

GAURAV: Hi, Hitesh. My portfolio is really suffering right now. I could use a good long-term investment. Any ideas?

HITESH: Well, Gaurav, did you hear about the new IPO [initial public offering] pharmaceutical company called Pharma Growth (PG) that came out last week? PG is a hot new company that should be a great investment. Its president and CEO was a mover and shaker at an Internet company that did great during the tech boom, and she has Pharma Growth growing by leaps and bounds.

GAURAV: No, I didn’t hear about it. Tell me more.

HITESH: Well, the company markets a generic drug sold over the Internet for people with a stomach condition that millions of people have. PG offers online advice on digestion and stomach health, and several Wall Street firms have issued “buy” ratings on the stock.

GAURAV: Wow, sounds like a great investment!

HITESH: Well, I bought some. I think it could do great.

GAURAV: I’ll buy some, too.

Gaurav proceeds to pull out his cell phone, call his broker, and place an order for 100 shares of PG.

Which of the following biases have been exhibited by Gaurav?

Section B (2 Mark)

Amount of liability of payment of gratuity is calculated at the rate of

Section C (4 Mark)

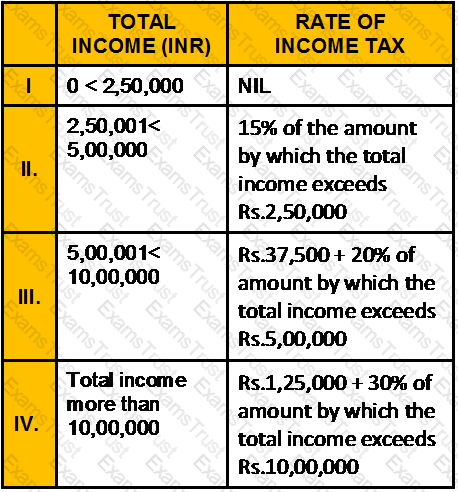

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $125000 in US dollars and he is a US citizen (single individual)

• $109000 in SGD and he is a citizen of Singapore

Section A (1 Mark)

Company J and Company K each recently reported the same earnings per share (EPS). Company J’s stock, however, trades at a higher price. Which of the following statements is most correct?

Section B (2 Mark)

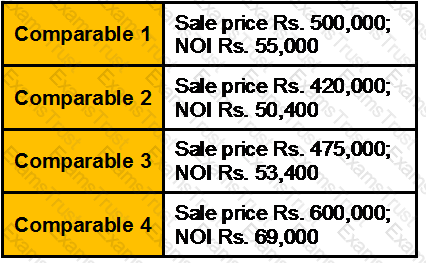

You have been asked to estimate the market value of an apartment complex that is producing annual net operating income of Rs44,500. Four highly similar and competitive apartment properties within two blocks of the subject property have sold in the past three months. All four offer essentially the same amenities and services as the subject. All were open-market transactions with similar terms of sale. All were financed with 30-year fixed-rate mortgages using 70 percent debt and 30 percent equity. The sale prices and estimated first-year net operating incomes were as follows:

What is the indicated value of the property using direct capitalization?

Section C (4 Mark)

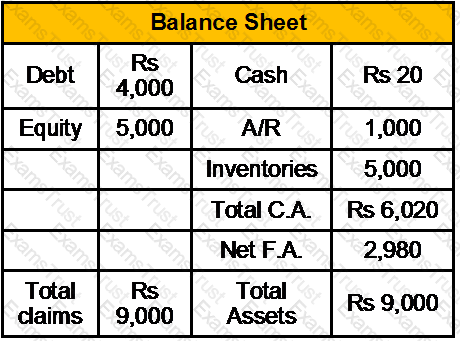

Your company had the following balance sheet and income statement information for 2003:

The industry average inventory turnover is 5. You think you can change your inventory control system so as to cause your turnover to equal the industry average, and this change is expected to have no effect on either sales or cost of goods sold. The cash generated from reducing inventories will be used to buy tax-exempt securities which have a 7 percent rate of return. What will your profit margin be after the change in inventories is reflected in the income statement?

Section A (1 Mark)

Single men trade far more often than women. This is due to greater ________ among men.

Section B (2 Mark)

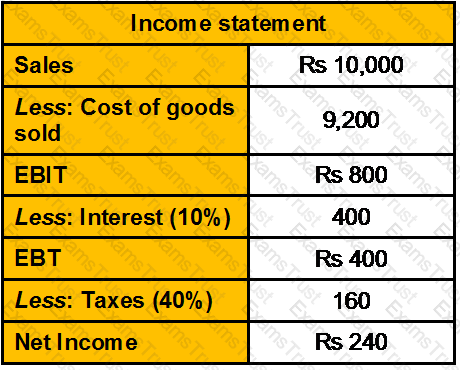

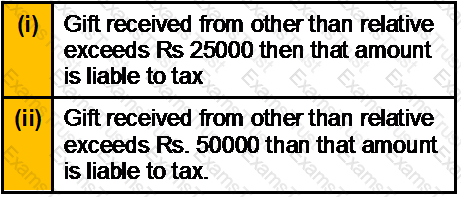

Which of the following statements is / are correct?

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the Net Worth of Mr. Adhikari as on 31/03/2009.

Section B (2 Mark)

A person is treated as being UK resident for a tax year if he or she is physically present in the UK for at least ___ days in the year or makes regular visits to the UK averaging at least ___ days per year. Fill in the blanks.

Section C (4 Mark)

Medicon is one the world's largest manufacturer of implantable biomedical devices, reported earnings per share in 1993 of Rs3.95, and paid dividends per share of Rs0.68. Its earnings are expected to grow 16% from 1994 to 1998, but the growth rate is expected to decline each year after that to a stable growth rate of 6% in 2003. The payout ratio is expected to remain unchanged from 1994 to 1998, after which it will increase each year to reach 60% in steady state. The stock is expected to have a beta of 1.25 from 1994 to 1998, after which the beta will decline each year to reach 1.00 by the time the firm becomes stable. (The Risk Free rate is 6.25%.)

Estimate the value per share, using the three-stage dividend discount model.

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Interest are:

Section A (1 Mark)

H Ltd, a UK resident company, owns 100% of the share capital of two other UK companies and 80% of the share capital of T SA, a company resident in Italy.H Ltd has three associated companies.

Section A (1 Mark)

Which portion of his property can a muslim normally be guest according to muslim personal law?

Section A (1 Mark)

_____________ is the transfer of the balance of an existing home loan that you availed at a higher rate of interest (ROI) to either the same HFC or another HFC at the current ROI a lower rate of interest.

Section A (1 Mark)

With regard to hedge funds, ‘2 and 20’ is best explained as:

Section A (1 Mark)

One of the tax exemption under avoidance of Double Taxation is U/S Sec 10(6)(ii) for exemption on income received by the diplomats, ambassador, etc

Section B (2 Mark)

Retiring early will ____________ the accumulation phase while ____________ the retirement phase

Section C (4 Mark)

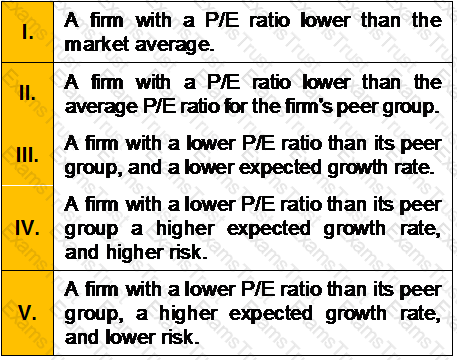

Which of the following would you consider the best indicator of an undervalued firm?

Section C (4 Mark)

The Meryl Corporation's common stock is currently selling at Rs100 per share, which represents a P/E ratio of 10. If the firm has 100 shares of common stock outstanding, a return on equity of 20 percent, and a debt ratio of 60 percent, what is its return on total assets (ROA)?

Section A (1 Mark)

__________ is a tangible company asset that can (and should) be inventoried and managed.

Section B (2 Mark)

The _________ is a plot of __________.

Section B (2 Mark)

A collar with a net outlay of approximately zero is an options strategy that

Section B (2 Mark)

Profitability Index is

Section A (1 Mark)

Data for five comparable income properties that sold recently are shown below:

What is the indicated overall rate (RO)?

Section A (1 Mark)

Income from which trust is added to the beneficiary’s taxable income?

Section B (2 Mark)

The lesson from the credit crisis of 2007-2009 is that securitized assets and credit swaps are:

Section A (1 Mark)

Long-term cash flow improvement may not be achieved by

Section B (2 Mark)

To pay for new equipment with a cash price of Rs7500, you need to borrow at 5.3% compounded monthly, then make monthly payments for 32 months. How many fewer months would it take to pay back the loan if you had also saved Rs600 to pay at the end?

Section A (1 Mark)

Real Estate market in India is __________

Section A (1 Mark)

Any property inherited by a female Hindu from her husband or from her father in law, in the absence of any son or daughter of the deceased shall go to…..

Section C (4 Mark)

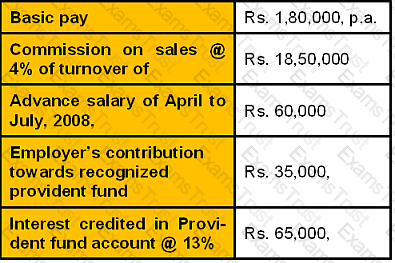

Mr. Sushobhan Adhikari, 56 years old, employee of Mega India Ltd, receives the following salary and perquisites from his employer during the previous year 2007–08.

A rent-free furnished house in Patna (rent of unfurnished house paid by employer- Rs. 84,000, rent of furniture Rs. 18,000, free services of a gardener (salary-Rs. 4,000), free services of cook (salary-Rs. 3,600), free services of watchman (salary-Rs. 900). He owns a small house at Patna.

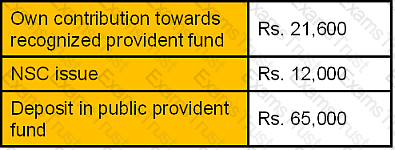

Mr. Adhikari makes the following payments and investments during the year:

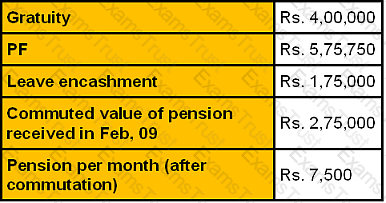

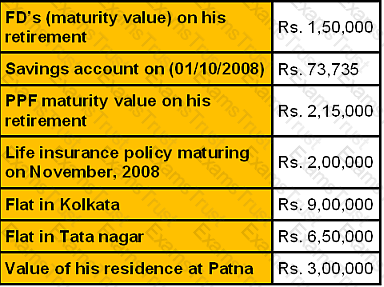

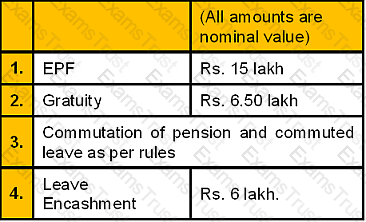

Mr. Adhikari comes to Mr. Gupta, CWM®, in September-2008 for developing a wealth plan to fulfill his financial goals. Mr. Adhikari will retire on 31st December, 2008 after completing 28 years of service. He is expecting a growth of Rs. 1,500 in his basic pay in the last year of his employment. The company is expecting a 5% growth every year in its turnover. His daughter Pallavi has completed her education and his main liability is the amount he may have to spend for her marriage. On his retirement he is expected to receive following amount:

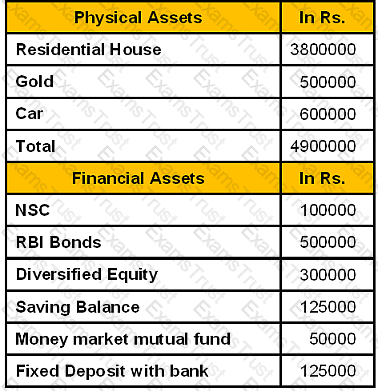

He also has also informed to the planner following his other assets and investments:

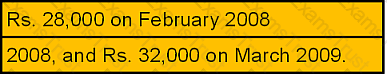

He has given his Kolkata Flat on 12,500 p.m. rent. Municipal value of the property is Rs. 1,45,000, fair rent is Rs. 1,60,000 and standard rent is 1,40,000. Municipal tax paid by him are as follows:

In July, 2008 rent is increased from Rs. 11,500 to Rs. 12,500 pm with effect from 01/04/2007. Due to some dispute rent was not received in 2007–08 but all arrears of rent till date are paid on July 1, 2008. Maximum eligible amount of PPF contribution deposited in March, 2008.

His actual expenses before retirement are Rs. 23,500 per month.

Main goals of Mr. Adhikari:

●To provide for his daughter’s marriage

●Ensuring that his family is protected financially in the event of any mishap

●Minimize tax burden

●Establish an investment portfolio that gives high returns over long term

Assumptions:

●Mr. Adhikari needs to provide for himself and his family till he is 75.

●Inflation rate after retirement to be 4%

●Monthly expenses after retirement will be 15% less than before retirement

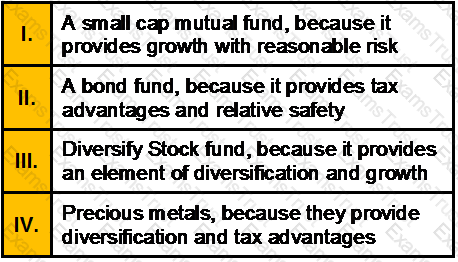

After detailed discussion, Mr. Gupta, CWM®, has suggested a revision in the portfolio as below to be implemented from October, 2008.

Section A (1 Mark)

With amortized loans, such as a mortgage:

Section B (2 Mark)

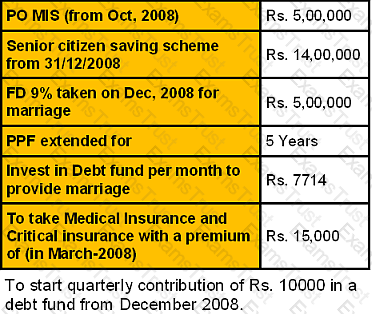

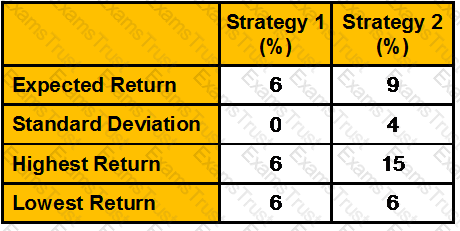

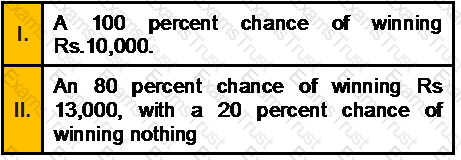

Consider these two investment strategies:

Strategy ___ is the dominant strategy because __________.

Section B (2 Mark)

A taxpayer has taxable income for 2011-12 (after deducting the personal allowance) of £75,200. None of the income is derived from savings or dividends. The income tax liability for the year is:

Section A (1 Mark)

All of the following are examples of excise taxes except:

Section A (1 Mark)

According to Michael Porter, there are five determinants of competition. An example of _____ is when new entrants to an industry our pressure on prices and profits.

Section B (2 Mark)

X Ltd. has given a dividend of Rs. 3 per share last year. The company is growing at a constant rate of 5 % every year and the investor’s required rate at this share is 12 % per annum. Find out the Intrinsic value of this share.

Section C (4 Mark)

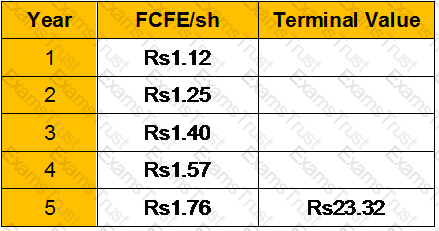

Watts Industries, a manufacturer of valves for industrial and residential use, had the following projected free cash flows to equity per share for the next five years , in nominal terms.

The terminal price is based upon a stable nominal growth rate of 6% a year after year 5. The discount rate, based upon financial market rates, is 14%, and the expected inflation rate is 3%.

Estimate the value per share, using nominal cash flows and the nominal discount rate.

Section A (1 Mark)

A zero-investment portfolio with a positive expected return arises when _________.

Section A (1 Mark)

Which of the following options is not true about CODICIL?

Section B (2 Mark)

A typical personal accident policy would normally have provisions to pay

Section A (1 Mark)

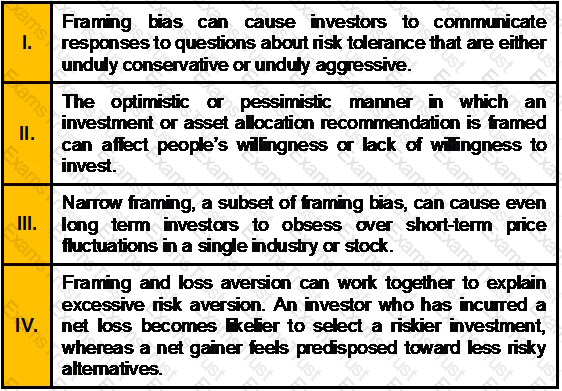

A cognitive heuristic in which people tend to reach conclusions based on the 'framework' within which a situation is presented; e.g. people are more lokely to recommend the use of a new procedure if it is described as having a '50% success rate' than a '50% failure rate'. Which of the following is most likely consistent with this bias?

Section A (1 Mark)

Convertible bond arbitrage is to event driven as _________ is to corporate restructuring.

Section B (2 Mark)

Property A provides an annual income of Rs. 160,000 and a similar property B has sold based on 8 % capitalization rates. Calculate the value at which property A can be priced.

Section B (2 Mark)

Payment of Gratuity Act 1972 is applicable to

Section A (1 Mark)

An activity is presumed to be a profit-making activity rather than a hobby if the

Section B (2 Mark)

The equity risk premium for the market is 8 percent. Jackson Products has a beta of 0.4. The real risk-free rate is 2 percent and the expected inflation premium is 5 percent. The required rate of return for Jackson is __________ percent.

Section A (1 Mark)

Judgement rating is used in case of

Section B (2 Mark)

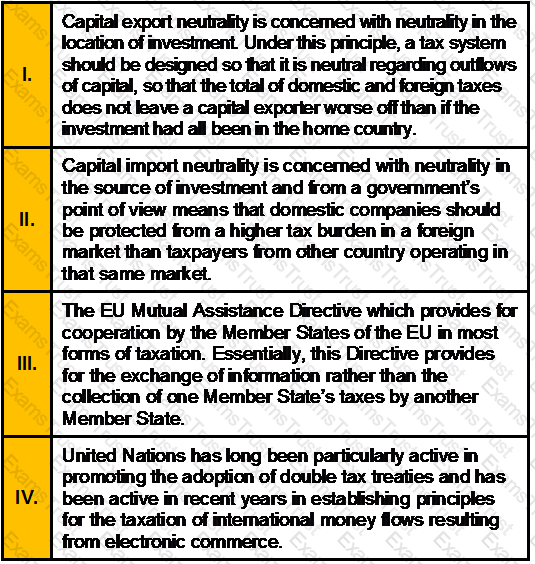

Which of the following statements with respect to International Taxation Structure is/are correct?

Section A (1 Mark)

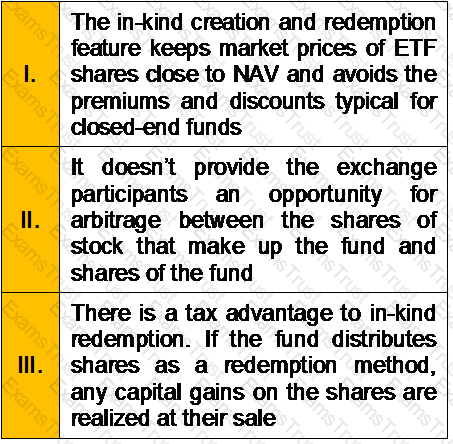

Which of the following is not a Key Benefit of the In-kind process used by the ETFs?

Section C (4 Mark)

Navin Corporation, a manufacturer of do-it-yourself hardware and housewares, reported earnings per share of Rs2.10 in 1993, on which it paid dividends per share of Rs0.69. Earnings are expected to grow 15% a year from 1994 to 1998, during which period the dividend payout ratio is expected to remain unchanged. After 1998, the earnings growth rate is expected to drop to a stable 6%, and the payout ratio is expected to increase to 65% of earnings. The firm has a beta of 1.40 currently, and it is expected to have a beta of 1.10 after 1998. The Risk Free rate is 6.25%.

What is the value of the stock, using the two-stage dividend discount model?

Section A (1 Mark)

Tarun has Rs. 100000/- in a account and starts investing Rs. 7500/-per month at the beginning of the month. If the account pays 10% p.a interest compounded half yearly. What will be the accumulated amount in his account after 20 years.

Section A (1 Mark)

Determine the status of X and Y who are the legal heirs of Z

Section B (2 Mark)

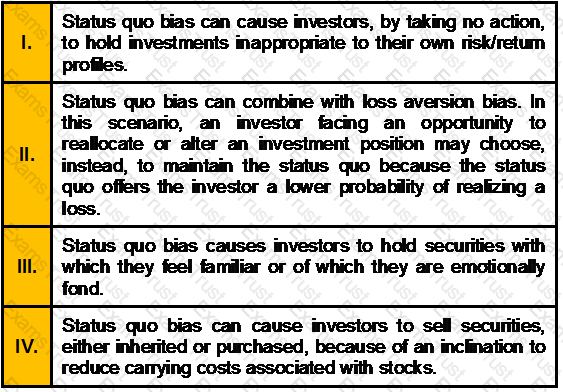

Which of the following two outcomes is an example of Status Quo Bias:

Section A (1 Mark)

The _______ is typically taken to be the risk-free rate.

Section B (2 Mark)

Calculate the value at which an office building can be priced from the following information:

A similar building has 8% capitalization rates.

Section C (4 Mark)

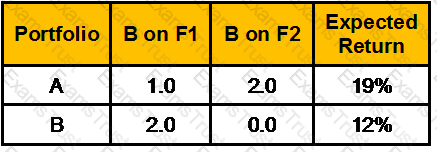

Consider the multifactor APT. There are two independent economic factors, F1 and F2. The risk-free rate of return is 6%. The following information is available about two well-diversified portfolios:

Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be __________.

Section A (1 Mark)

Riskier stocks have

Section A (1 Mark)

Mansi deposits Rs. 50,000/- in a bank account which pays interest @ 10 % per annum. How much can be withdrawn at the beginning of each year for 5 years if first withdrawal is 6 years from now?

Section B (2 Mark)

An Indian citizen leaving India during the previous year for employment purpose is said to be resident If:

Section A (1 Mark)

The difference between a wagering contract and insurance contract is ___________.

Section A (1 Mark)

A draft of a will prepared by the head of the family which will decide the nature in which his properties will be distrubuted among his heirs is known as_____________________.

Section A (1 Mark)

After buying two stocks, one rises by 25% an d the other drops by 25%. You congratulate yourself on your brilliance for the first stock and blame bad luck on the second. You are demonstrating which investor bias?

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Royalties in Mauritius is charged at:

Section B (2 Mark)

You buy a share of ABC Ltd for Rs. 20. You expect it to pay dividends of Re.1, Rs.1.10 and Rs.1.21 in coming three years. Calculate the growth rate in dividend:

Section B (2 Mark)

Both __________ depend on electronic information that has been collected about customers, in place of human knowledge, to build and manage relationships.

Section A (1 Mark)

Which type of portfolio allocation is usually done once every few years?

Section B (2 Mark)

Mr. Patel expects the stock of A to sell for Rs. 70/- a year from now and to pay Rs. 4/- dividend. If the stock’s correlation with the Market is –0.3, and the standard deviation of A is 40% and standard deviation of the Market is 20% and the risk free rate of return is 5% and the market risk premium is 5%, what would be the price of stock A be now ?

Section A (1 Mark)

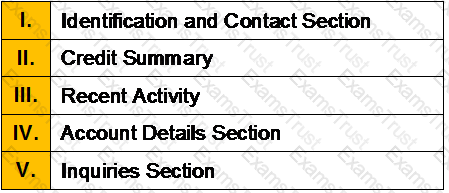

Equifax Credit Report Contain

Section B (2 Mark)

A constant proportion portfolio insurance (CPPI) policy calls for:

Section C (4 Mark)

Suppose Nifty is at 4450 on 27th April. An investor, Mr. A enters a long straddle by buying a May Rs 4500 Nifty Put for Rs. 85 and a May Rs. 4500 Nifty Call for Rs. 122.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3729

• If Nifty closes at 5214

Section B (2 Mark)

The ____________ provides an unequivocal statement on the expected return-beta relationship for all assets, whereas the _____________ implies that this relationship holds for all but perhaps a small number of securities.

Section B (2 Mark)

As a result of a lawsuit, Catherine was awarded $300,000 for compensatory damages and $400,000 for punitive damages. What is the taxable income resulting from this suit?

Section A (1 Mark)

Debt Equity Ratio is 3:1,the amount of total assets Rs.20 lac, current ratio is 1.5:1 and owned funds Rs.3 lac. What is the amount of current asset?

Section A (1 Mark)

Generally speaking, high severity of losses will be accompanied by

Section B (2 Mark)

In the calculation of rates of return on common stock, dividends are _______ and capital gains are _____.

Section A (1 Mark)

While matching orders for equity trading in NSE, which one of the following gets precedence over all the others?

Section A (1 Mark)

A(n)_______________ is a credit-rating agency that keeps records of borrowers' loan payment histories.

Section B (2 Mark)

Reliable ltd. has current earnings per share of Rs. 5. Assume a dividend – payout ratio of 50 percent. Earnings grow at a rate of 9 percent per year. If the required rate of return is 14 percent, what is its current value?

Section A (1 Mark)

The covariance of the market returns with the stocks returns is 0.008. The standard deviation of the market is 8% and standard deviation of stock’s return is 11%. What is the correlation coefficient between stocks and market returns?

Section A (1 Mark)

A 15 year annuity due has a future value of Rs. 15,00,000/- If ROI is 9 % per annum, then how much will be each annuity amount ?

Section A (1 Mark)

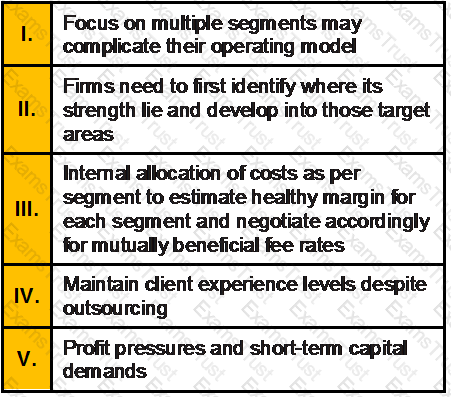

Which of the following is/are the challenges of Private Banking?

Section A (1 Mark)

_______________ consists of the constatation that people buy both insurances and lottery tickets .

Section B (2 Mark)

What is the PV of an Annuity Due which provides Rs. 2,000/- per month for first 3 years and then Rs. 3,000/- per month for next 2 years. This annuity starts 4 years from now and ROI is 9 % per annum compounded monthly?

Section C (4 Mark)

Monika has a investment portfolio of Rs. 100000, a floor of Rs. 75000, and a multiplier of 2. So the initial portfolio mix is 50000 in stocks and 50000 in bonds. If stock market falls by 20%, what should Monika do?

Section A (1 Mark)

In order to remain competitive, non-core providers need to achieve the following:

Section B (2 Mark)

Consider the single-factor APT. Stocks A and B have expected returns of 15% and 18%, respectively. The risk-free rate of return is 6%. Stock B has a beta of 1.0. If arbitrage opportunities are ruled out, stock A has a beta of __________.

Section B (2 Mark)

Manav wishes to calculate that if he wants to withdraw Rs. 2,000/- every Quarter at start of the month for 6 years, then how much amount is required to be in his account today. He wants to start this withdrawal immediately and ROI is 9 % per annum compounded quarterly.

Section C (4 Mark)

Mr. XYZ is bullish on Nifty when it is at 4191.10. He sells a Put option with a strike price of Rs. 4100 at a premium of Rs. 170.50 expiring on 31st July. If the Nifty index stays above 4100, he will gain the amount of premium as the Put buyer won’t exercise his option. In case the Nifty falls below 4100, Put buyer will exercise the option and the Mr. XYZ will start losing money. If the Nifty falls below 3929.50, which is the breakeven point, Mr. XYZ will lose the premium and more depending on the extent of the fall in Nifty.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3400

• If Nifty closes at 4800

Section A (1 Mark)

One aspect of the tax considerations in asset allocation is that

Section A (1 Mark)

The trust which is empty at creation during life and tranfers the property into the trust at death is called ____________

Section C (4 Mark)

Arvind Ltd. currently EPS is Rs.5. Its return on equity (ROE) is 25% and it retains 60% of its earning. Stocks of similar risk are priced to return 18%. What is the intrinsic value of Arvind Ltd’s Stock?

Section C (4 Mark)

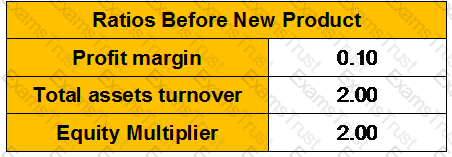

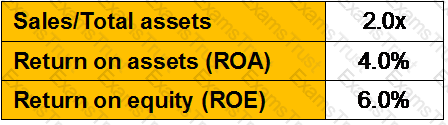

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

Section A (1 Mark)

Financial Independence usually occurs between _______

Section B (2 Mark)

Hybrid plans are

Section A (1 Mark)

After the satisfaction of insured’s claim from the insurer, the insured should pursue in the recovering of rights from the 3rd party.

Section B (2 Mark)

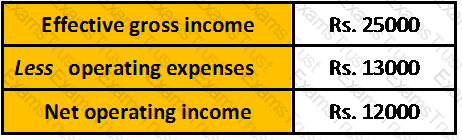

The estimated Net Operating Income of an office building is Rs. 12000 per year. An appraiser decide the appropriate capitalization rate is 12% comprised of 10% return on investment and 2% for depreciation, what is the estimated value of the building?

Section B (2 Mark)

Suppose you are working with two factor portfolios, Portfolio 1 and Portfolio 2. The portfolios have expected returns of 15% and 6%, respectively. Based on this information, what would be the expected return on well-diversified portfolio A, if A has a beta of 0.80 on the first factor and 0.50 on the second factor? The risk-free rate is 3%.

Section A (1 Mark)

Which part of the wealth management planning deals with efficient and optimum use of credit for the business.?

Section A (1 Mark)

How many sections are there in Householder’s Insurance Policy?

Section B (2 Mark)

Reliance Ltd. has issued a preferred stock that pays Rs.10 per share. The dividend is fixed and the stock has no expiration date. What is the intrinsic value of Reliance Ltd. stock, assuming a discount rate of 14%?

Section A (1 Mark)

The inventory turnover ratio and days sales outstanding (DSO) are two ratios that can be used to assess how effectively the firm is managing its assets in consideration of current and projected operating levels.

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Dividends are:

Section C (4 Mark)

KB, a household product manufacturer, reported earnings per share of Rs3.20 in 1993, and paid dividends per share of Rs1.70 in that year. The firm reported depreciation of Rs315 million in 1993, and capital expenditures of Rs475 million. (There were 160 million shares outstanding, trading at Rs51 per share.) This ratio of capital expenditures to depreciation is expected to be maintained in the long term. The working capital needs are negligible. KB had debt outstanding of Rs1.6 billion, and intends to maintain its current financing mix (of debt and equity) to finance future investment needs. The firm is in steady state and earnings are expected to grow 7% a year. The stock had a beta of 1.05. (The Risk Free Rate is 6.25%.)

Estimate the value per share, using the FCFE Model.

Section C (4 Mark)

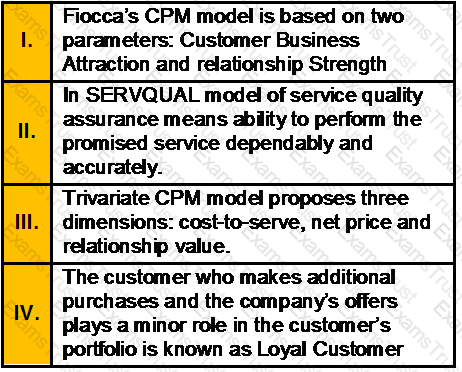

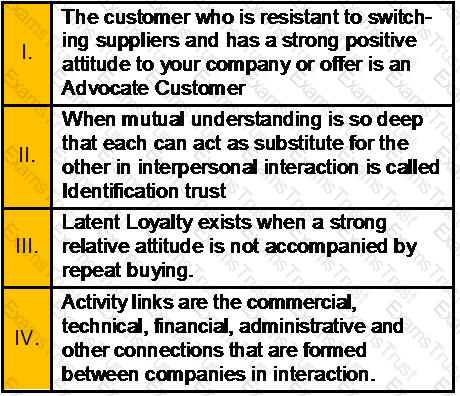

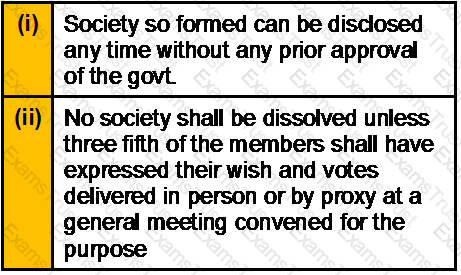

Which of the following statements is/are correct?

Section B (2 Mark)

PPF is a

Section C (4 Mark)

To create a common size income statement ____________ all items on the income statement by ____________.

Section A (1 Mark)

In a bull spread, the investor makes profits if market goes

Section A (1 Mark)

The disposition effect relates to the fact that:

Section A (1 Mark)

A firm in an industry that is very sensitive to the business cycle will likely have a stock beta ___________.

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable income is:

• $ 83560 in SGD and he is a Singapore citizen

• £ 73150p.a (only employment) and he is a UK citizen

Section B (2 Mark)

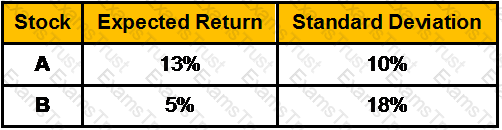

The expected returns and standard deviations of stock A and B are:

Manish buys Rs.20000 stock A and sells short Rs.10000 of stock B, using all the proceeds to buy more of stock A. The correlation between the two securities is 0.25. What are the expected return and the standard deviation of Manish’s portfolio?

Section C (4 Mark)

Pizer Drugs, a large drugstore chain, had sales per share of Rs122 in 1993, on which it reported earnings per share of Rs2.45 and paid a dividend per share of Rs1.12. The company is expected to grow 6% in the long term, and has a beta of 0.90. The current Risk Free Rate is 7%.

Estimate the appropriate Price for Pizer Drug and what would the profit margin need to be to justify the price per share if the stock is currently trading for Rs34 per share, assuming the growth rate is estimated correctly,

Section A (1 Mark)

_____________seek to explain people's preferences in relation to consumption and saving over the course of their life.

Section B (2 Mark)

As Per Article 12 Double Taxation Avoidance Agreement with US, _____per cent of the gross amount of the royalties or fees for included services as defined in this Article, where the payer of the royalties or fees is the Government of that Contracting State, a political sub-division or a public sector company.

Section B (2 Mark)

Which one of the above statements is/are incorrect?

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the income chargeable to tax from rented flat of Kolkata, for the assessment years 2008–09 and 2009–10.

Section A (1 Mark)

An American call option can be exercised

Section B (2 Mark)

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

Section A (1 Mark)

Which of the following is a market anomaly?

Section B (2 Mark)

Lokesh purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-.As a CWM® calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

Section B (2 Mark)

Fifteen Year ago, Sandeep set up his initial allocation in her defined contribution plan by placing an equal amount in each asset class and never changed it. Over time, he increased his contribution by 3 % per year until he reached maximum amount allowed by law. Which of the following biases that Sandeep suffers from?

Section A (1 Mark)

A document that is executed by the sellor of the flat so that the Cooperative Society to which the flat belongs and the purchaser is completely indemnified against any claims that any other person may make on the rights of ownership of the flat or other any that is yet unpaid by the seller ( eg. taxes) is known as_________

Section A (1 Mark)

Vineet invests Rs. 5000/- per month at the beginning of the month for 10 years in Recurring Deposit account that pays 8.5% p.a interest compounded quarterly. What will be the accumulated amount in his account.

Section B (2 Mark)

Which of the following is/are the Potential Challenges for wealth management players in India:

Section B (2 Mark)

The current market price of a share of MOD stock is Rs15. If a put option on this stock has a strike price of Rs20, the put

Section A (1 Mark)

The CDO structures which are used by asset management companies, insurance companies and other investment shops with the intent of exploiting a mismatch between the yield of underlying securities and lower cost of servicing the CDO structures are called___________.

Section B (2 Mark)

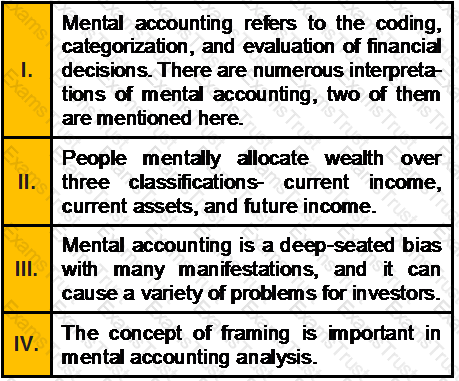

Which of the following statements is/are correct with respect to Mental Accounting?

Section B (2 Mark)

Consider the one-factor APT. The variance of returns on the factor portfolio is 6%. The beta of a well-diversified portfolio on the factor is 1.1. The variance of returns on the well-diversified portfolio is approximately __________.

Section C (4 Mark)

Samantha celebrated her 21st birthday today, her father gave her Rs. 6,25,000/- which is deposited in a account that pays a ROI of 12.25% p.a. compounded monthly. If she wants to withdraw Rs. 7,50,000 on her 31st. Birthday and balance on her 41stBirthday. How much can she withdraw on her 41st. birthday ?

Section C (4 Mark)

Read the senario and answer to the question.

For the purpose of World Tour Nimita has an option to use her investments in PPF A/c. She would contribute maximum permissible amount on the 1st working day of April every year till its due maturity as well as in all years of the extension of account for a 5-year term after its due maturity. She wants to use half of the PPF account proceeds for the proposed world tour. You estimate the adequacy of such amount, the same is _____________.

Section A (1 Mark)

The concept of indemnity is based on the key principle that policyholders should be prevented from

Section A (1 Mark)

What would be the tax liability if tea and snacks are provided in the office after office hours?

Section C (4 Mark)

Which of the following statements is/are correct?

Section A (1 Mark)

Pure premium and Loss Ratio methods are two methods to determine

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Mehta buys machinery for Rs. 80000 which is to be replaced after a period of two years. The replacement cost at that time will be Rs. 90000. As a Chartered Wealth Manager advice Mr. Mehta now what he should do after two year for the replacement of the said machinery?

Section B (2 Mark)

The arbitrage pricing theory (APT) and the CAPM both assume all except which of the following?

Section A (1 Mark)

Passive Preserver follows a ___________ Investment Style

Section C (4 Mark)

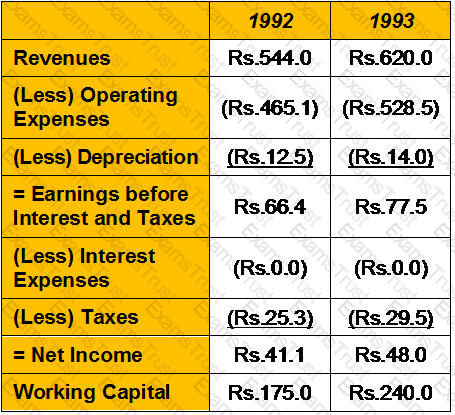

Dab Ltd manufactures, markets, and services automated teller machines. The following are selected numbers from the financial statements for 1992 and 1993 (in millions):

The firm had capital expenditures of Rs15 million in 1992 and Rs18 million in 1993. The working capital in 1991 was Rs180 million.

Estimate the cash flows to equity in 1992 and 1993. (in Rs Millions)

Section B (2 Mark)

The current market price of a share of XYZ stock is Rs50. If a call option on this stock has a strike price of Rs45, the call

Section B (2 Mark)

How much total interest is paid between the 5th and 11th payments inclusive on a loan that has monthly payments for 2 years and an original principal of Rs47 500? The loan rate is 6.6% compounded quarterly.

Section B (2 Mark)

Which of the following statements is / are correct?

Section A (1 Mark)

Limited growth prospects are indicated by

Section B (2 Mark)

Which of the following Statements are correct?

Section A (1 Mark)

Deduction under section 80-IC is allowed to the extent of:

Section B (2 Mark)

Portfolio A has expected return of 10% and standard deviation of 19%. Portfolio B has expected return of 12% and standard deviation of 17%. Rational investors will

Section A (1 Mark)

In order to have confirmation of a major market trend under the Dow Theory, the

Section A (1 Mark)

REIT Preferred Stock can offer lower total returns than common stock and have some liquidity issues as well.

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $ 142700 in US dollars and he is a US citizen (married Individual Filing Joint returns and Surviving Spouses)

• $ 67250 in SGD and he is a citizen of Singapore

Section A (1 Mark)

In US How many states do not have a personal income tax?

Section B (2 Mark)

Which of the following are the two skills associated with being a good listener?

Section B (2 Mark)

Customer relationship management applications dealing with the analysis of customer data to provide information for improving business performance best describes by which of the following?

Section A (1 Mark)

What amount needs to be invested today at 10 % per annum, so that it pays Rs. 1 lac per annum for 5 years, starting from 6th year to 10thyear. First payment starts at BEGIN of 6thyear.?

Section B (2 Mark)

Which of the following statements is/are correct with respect for Resident Senior Citizen i.e. who is of an age of 60 years and above, but below 80 years?

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the retirement corpus required by Raman to generate his post-retirement expenses.

Section B (2 Mark)

For calculation of liability of payment of gratuity to an employee on leaving service, the wage to be taken into account is

Section A (1 Mark)

Which of the following is an effective strategy in times of falling interest rates?

Section B (2 Mark)

The Wilson Corporation has the following relationships:

What is Wilson’s profit margin and debt ratio?

Section A (1 Mark)

Another name for open-end credit is:

Section A (1 Mark)

Anurag has invested Rs. 10 lakh. in a pension fund that pays an interest rate of 12% p.a. compounded quarterly. If Anurag wants to withdraw money after 25 years every month for next 20 years what amount can he withdraw.

Section A (1 Mark)

Which of the following is/are the challenges of Private Banking?

Section C (4 Mark)

Read the senario and answer to the question.

Portfolio A had a return of 12% in the previous year, while the market had an average return of 10%. The standard deviation of the portfolio was calculated to be 20%, while the standard deviation of the market was 15% over the same time period. If the correlation between the portfolio and the market is 0.8, what is the Beta of the portfolio A?

Section B (2 Mark)

In 2011-12, Steven has business profits of £34,125, net bank interest of £1,240 and net dividends of £9,000. He claims the personal allowance of £7,475. What is the income tax payable for the year after subtracting tax deducted at source?

Section B (2 Mark)

Which one of the above statements is/are correct?

Section A (1 Mark)

During “Early accumulation” life stage, typical asset allocation should be

Section A (1 Mark)

Why have consumers/customers been so hyper-aware and so nervous?

Section C (4 Mark)

Read the senario and answer to the question.

Saxena bought agricultural land in notified urban limits of Mumbai on 15-June-1996 for Rs. 6 lakh and had been using the same for agricultural purposes. However the land was compulsorily acquired by the Government on 15-July-2003 and the compensation fixed was Rs. 25 lakh. Out of this, Rs 10 lakh was received by Saxena on 15-Jan-2005 and the balance on 06-Apr-2005. Saxena was not satisfied with the compensation and filed a suit in the court. The compensation was enhanced by Rs 8 lakh which was received on 25-Mar-2008. Which one of the following statement regarding capital gains arising from these transactions is correct:

Section B (2 Mark)

Expenses are 10% of the gross (office) premium. Pure premium is Rs. 200. Calculate office premium.

Section A (1 Mark)

A cognitive heuristic in which decisions are made based on how representative a given individual case appears to be independent of other information about its actual likelihood. We tend to think that trends we observe are likely to continue. Which of the following is most likely consistent with this bias?

Section A (1 Mark)

Which of the following is an advantage of a credit scoring model?

Section C (4 Mark)

An investor Mr. Dayal, executes a Long Strangle by buying a Rs. 4300 Nifty Put for a premium of Rs. 23 and a Rs 4700Nifty Call for Rs 43. The Nifty is at 4500

The Net Payoff of Long Strangle

• If Nifty closes at 4100

• If Nifty closes at 5300

Section B (2 Mark)

What is the size of the final unequal payment of a loan for Rs15 600 and it has monthly payments of Rs500? The interest rate is 9.92% compounded quarterly.

Section C (4 Mark)

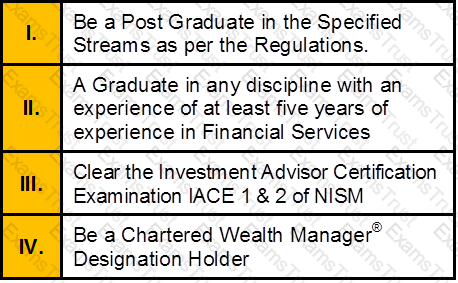

To fulfil the Educational Qualification to be registered as an Investment Advisor under the SEBI Investment Advisor Regulations 2013, The applicant must:

Section B (2 Mark)

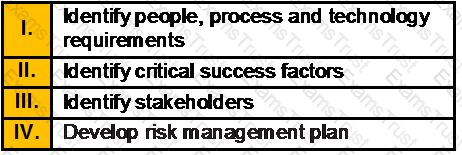

Which of the following activities is/are a part of “Building the CRM project foundation phase “in CRM implementation?

Section B (2 Mark)

Basic Idea of retirement benefit plan is

Section B (2 Mark)

Number One Flight Stock currently sells for Rs53. A one-year call option with strike price of Rs58 sells for Rs10, and the risk free interest rate is 5.5%. What is the price of a one-year put with strike price of Rs58?

Section B (2 Mark)

A hedge fund manager purchases 10 convertible bonds with a par value of $1,000, a coupon of 7.5%, and a market price of $900. The conversion ratio for the bonds is 20. The conversion ratio is based on the current price of the underlying stock, $45, and the current price of the convertible bond. The delta, or hedge ratio, for the bonds is 0.4.

Therefore, to hedge the equity exposure in the convertible bond, the hedge fund manager must short the following shares of underlying stock:

Section A (1 Mark)

A(n) _____________ is an assurance that investors will be repaid in the event of the default of the underlying loans in a securitization. These can be internal or external to the securitization process and lower the risk of the securities.

Section A (1 Mark)

Manav saves Rs. 20,000/- a year for 5 years and Rs. 30,000/- a year for 10 years thereafter. What will be the total amount in his account after 15 years, if ROI is 10 % per annum?

Section C (4 Mark)

Mr. Vinay, aged 36 years is working in a company, at a managerial level, and has an income of Rs. 40,000 p.m. comprising of Basic salary and DA as on 31/03/2008. His other allowances amount to Rs. 18,000 p.m. He would retire at the age of 60 years. His wife Reena, aged 32 years, is working in a High School and has a post-tax income of Rs. 2,76,000 per annum. Mr. and Mrs. Vinay have two daughter Deepika, aged 10 years and Rekha, aged 5 years.

Mr. Vinay, aged 36 years is working in a company, at a managerial level, and has an income of Rs. 40,000 p.m. comprising of Basic salary and DA as on 31/03/2008. His other allowances amount to Rs. 18,000 p.m. He would retire at the age of 60 years. His wife Reena, aged 32 years, is working in a High School and has a post-tax income of Rs. 2,76,000 per annum. Mr. and Mrs. Vinay have two daughter Deepika, aged 10 years and Rekha, aged 5 years.

Mr. Vinay’s father died of heart attack, 5 months back, at the age of 72 years, leaving a house (Value as on date Rs. 30 lakh) in which Vinay is staying at present and other assets worth Rs. 20 lakh (shares of large cap companies worth Rs. 10 lakh, Fixed deposit in post office of Rs. 5 lakh and Bank FD of Rs. 5 lakh) in Vinay’s mother’s name. His mother 63 years old is disabled and fully dependent on Vinay, he being the only child of his parents. Vinay has to keep an attendant for his mother, round the clock.

The Assets of the Couple are:

1.Cash in HandRs. 18,000

2.Bank balanceRs. 40,000 (Vinay) Rs. 25,000 (Reena)

3.JewelleryRs. 400000 (Reena)

4.Money Market Mutual FundRs. 3,00,000 (Vinay)

5.Shares

?ICICI Bank 200 shares bought at Rs. 1000 per share,

?Infosys 150 shares bought at Rs. 1700 per share

?Reliance Communication 350 shares bought at Rs. 350 share.

6.Debt oriented mutual FundsRs. 2,00,000

7.PPFRs. 5,00,000 (Vinay), Rs. 4,00,000 (Reena)

8.House in the joint name of Vinay and Reena with 50% ownership of each. This house has two floors and is let out for Rs. 9,000 pm for each of the floors. Present value of this house is Rs. 60,00,000.

Vinay and Reena had taken a housing loan of Rs. 15,00,000 each. Of this Rs. 10,00,000 is pending on each name. They are presently paying an EMI of Rs. 20,000 each, Rate of interest being 10.75% p.a.

The Retirement Benefits of Vinay after 15 years hence, are expected to be as follows:

Vinay has taken a term insurance of Rs. 30 lakh for 20 years, which is expiring 5 years from now. He has no other insurance. Vinay’s monthly household/ living expenses are Rs. 50,000. This excludes EMI on loans but includes all other expenses including expenses on his mother’s care.

Vinay expects Deepika to get married 12 years hence for which likely expenditures in today’s term is 15 lakh.

Vinay’s salary is likely to grow at 7% pa and Reena’s salary is likely to grow at 6% p.a. Risk free rate of interest is 8% pa and inflation is 6% p.a. Long term growth on Equity/Equity based MF is taken as 15% p.a.

Section C (4 Mark)

Read the senario and answer to the question.

Which types(s) of investment(s), would be consistent with their retirement goal?

Section A (1 Mark)

Which of the following services are related to the field of Real Estate?

Section C (4 Mark)

Two friends Neeraj and Kapil, both belonging to the 33.66% tax bracket, have invested Rs. 10 lakhs in a debt-based scheme. The scheme is a regular run of the mill, assembly line product — nothing extraordinary about it.

The scheme has earned a distributable profit of 12%.

Kapil’s financial condition is not good and due to the business losses his assets are to be auctioned.

Neeraj is working in MNC and getting an annual package of Rs. 18 lakhs. This includes Rs. 270000 as dearness allowance (2/3 forms the part of retirement benefit). He is also earning an agricultural income of Rs. 54000.His expenses are Rs. 80000 per month.

Neeraj has also taken a housing loan in joint name of his wife Anita and himself. Property is also in the joint name and their contribution is equal. Annual outflow towards housing loan in terms of repayment of principal and interest is Rs. 300000. Out of this Rs. 198800 is toward interest.

Neeraj has also invested an equal amount in a portfolio consisting of securities A and B. Standard deviation of A is 12.43%; Standard deviation of B is 16.54%; Correlation coefficient is 0.82

Assets held by Neeraj

Section B (2 Mark)

An investment opportunity having a market price of Rs. 100,000 is available. You could obtain a Rs. 75,000, 25-year mortgage loan requiring equal monthly payments with interest at 9.5 percent. The following operating results are expected during the first year.

What is the Overall capitalization rate?

Section A (1 Mark)

The borrower's attitude toward his or her credit obligations is called: