Employee Dan, a sales representative, is reimbursed for business travel expenses incurred for out-of-town trips. Dan completes an expense report each month showing the date expenses were incurred and receipts substantiating the amount of the expenses. In August, Dan's employer reimbursed travel expenses of $500 for meals, $1,200 for hotels, and $900 for airfare. Choose the answer that properly reflects the income Dan must declare and the corporate tax deduction that Dan's employer may claim

Under FLSA , what is the compensation due an employee whose rate of pay is $8 per hour and who is paid for 52 hours during a one-week period, including 8 hours of sick pay?

Which of the following employees is most likely to be an exempt professional under FLSA?

The annual "bright-line" salary test to meet the definition of exempt under the FLSA is:

Which of the following is an example of a system edit?

For an employee earning $10.20 per hour and participating in a 401(k) plan with a deferral per pay period of $50, compute the federal taxable wages based on the following: Biweekly pay period Regular 80 hours 4 hours overtime 3 hours double-time:

Which of the following is an example of a system production control technique?

Which of the following would NOT be an asset account?

The correct entry to record a payment of the employer's share of FICA tax is:

Which of the following would not be included in the Needs Analysis stage of a system evaluation?

Employer-sponsored athletic facilities may not be nontaxable fringe benefits if the:

Beth, who works for Nugget Productions, is enrolled in the company's cafeteria plan. Beth adopts a child in august, and requests a change in her election under the cafeteria plan. What is the action that may be taken?

As part of the implementation of a new payroll system, all transactions from the most recent actual payroll are processed in the new system prior to using the system to run payrolls. This is an example of what type of testing?

The entry to recorded an employee's repayment of a salary advance is (employee repays advance by personal check):

Copies of the production files and most recent payroll transactions are sent nightly to the parent company in a remote location. this practice is part of what type of plan?

A payroll department manager should assure:

Bass Biting Company operates bait, tackle and boat sales store employing 12 full time clerks and salespeople in addition to the owner and his family members. Occasionally, Bass Biting assigns special work to individuals other than its regular employees and family members. Only two employees, George the President, and Earl, a salesperson, receive group-term life insurance. The value of each of their group-term life benefit is $93 per month, and $23 per month after excluding the first $50,000 of coverage. How much is exempt from wages?

Certain company records must be retained for four years to comply with regulations of which of the following agencies?

A report has been requested that is NOT a standard report from the system. This type of report is called a (n):

A service company sends employees overseas on assignments that last no more than 4 months at a time. Which of the following is true with respect to the taxation of those employees?

Which of the following general ledger accounts is integral to a quarterly deposit reconciliation?

Which of the following records MUST be kept for four years?

Which of the following would never be delegated to a manger's subordinates?

An employer may exclude a business reimbursement from income when the employee's expenses meet which of the following requirements?

Under IRS suggested guidelines, an employee should be allowed a maximum of how many days after receiving an expense advance to provide substantiation for the amount to the employer?

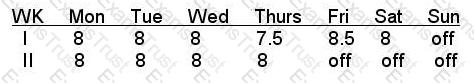

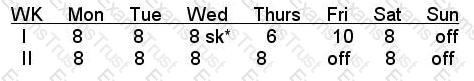

Under the FLSA, how many hours would be paid at time and one half for the following biweekly period, assuming that the employee is an garment worker?

A salaried-exempt executive employee is unable to work for two days in the work week because the office is closed for remodeling. The employee's weekly guaranteed salary is $500. Under FLSA what amount must this employee be paid for he work week?

Under FLSA, how many hours must be paid at the overtime rate of pay for the following biweekly period:

Represents 8 hours of sick pay leave:

Brenda receives a prize as a winner of a sales contest. The prize, which is paid from her sales manager's petty cash account, is $25. Which of the following best represents the impact on her taxable wages?

Under the FLSA, how long are employers required to keep records relating to wages, hours, and conditions of employment?

A U.S. citizen working for a foreign employer outside the United States is subject to which of the following taxes?

Which of the following items represents an input interface to the payroll system?

Which of the following would NOT be correct in the treatment of deceased workers' wages, assuming the wages are paid in the year after the workers' death?

The Fair Labor Standards Act specifically governs which of the following?

The form used to report wages paid to nonresident aliens that are exempt from federal income tax under a treaty is:

Josh, a nonexempt accounting specialist, is assigned to a normal work schedule of 40 hours a week, 8:00 a.m. to 5:00 p.m. each day, with one hour for lunch. On Monday, Josh travels by train from Boston to a business meeting in his company's Philadelphia office. The train leaves at 8:00 a.m. and arrives in time for Josh to attend the afternoon meeting, which concludes at 5:30 p.m. He then returns to Boston on a train that leaves at 7:00 p.m. If Josh does not miss any work the rest of the week, what hours for Monday may be subject to overtime?

An employer is allowed under deferral law to pay overtime for all hours worked over 80 in a biweekly period. In what type of industry is this employer likely to be engaged?