An internal audit is an independent appraisal function established within an organization to examine and evaluate its activities as a service to the organization

Which of the following appoints the internal auditor?

Which of the following represent items of income for a business?

Cost of goods sold for a manufacturing company is the total of

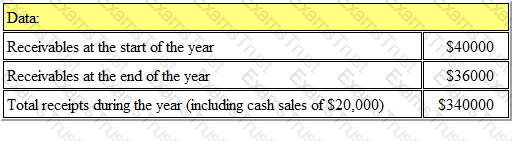

Refer to the Exhibit.

You are given the following information:

What did sales on credit amount to during the year?

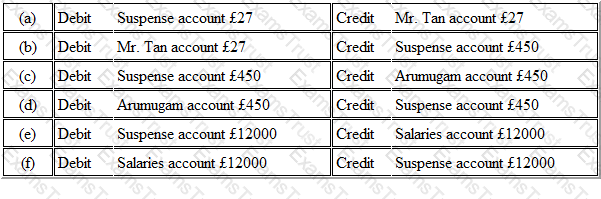

Refer to the exhibit.

The trial balance of Monchu Partnership, as at 30 June 2006, has a suspense account. Subsequent investigations revealed that:

(1) A payment of £352 to Mr. Tan was posted as £325.

(2) A remittance of £450 received from Arumugam was credited to Armits accounts.

(3) Salaries of £12000 have not been posted from the cash book.

Monchu suggested the following adjustments:

The appropriate journal entries are:

Refer to the Exhibit.

Which of the following items should be included in the valuation of inventory in a manufacturing company?

Which one of the following is an error of original entry?

If a profitable entity is not required to register for sales tax with its local tax authority, which of the following statements is TRUE?

An organization restores its petty cash balance to £350 at the end of each month.

During October, the total expenditure column in the petty cash book was calculated as being £310, and hence the impress was restored by this amount. The analysis columns, which had been posted to the nominal ledger, totaled only £300.

This error would result in:

Refer to the Exhibit.

A company has the following chart of accounts:

The sales director of the northern region wants to know what the total sales of widgets are for the first quarter of the year.

Which code would he request for his report?

Which of the following is not a book of prime entry?

Which of the following is not an external user of financial statements?

FY owns bakery T. Which of the following are examples of FY's liabilities?

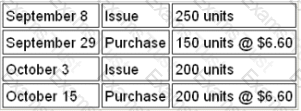

Refer to the Exhibit.

A company operates an AVCO system of inventory. Opening inventory at the beginning of the period was 400 units @ $6.50 per unit.

During the period, the following purchases and issues were recorded:

The amount charged to the company's income statement in the period is

In the year ended 31 December 20X1, XYZ receives an email confirming that a major customer has gone into liquidation and will be unable to pay its suppliers.

Which of the following is the impact of adjusting for this event?

Which one of the following attributes is the most important for any code to possess, in order to be of use in an accounting system?

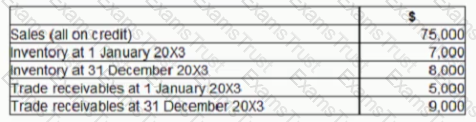

MM does not maintain complete accounting records The following information is available for the year ended 31 December 20X3.

The mark up on items sold by MM is 20%

What is the figure for purchases to be included in MM's statement of profit or loss for the year ended 31 December 20X3?

A company uses the straight line method of depreciation.

Which TWO of the following are a possible explanation for a profit on disposal?

On 1 January 2001, a company owed a supplier £840.

During the month of January the company purchased goods for £1400 and returned goods valued at £200. A payment of £200 was made towards the outstanding balance. The supplier offered a discount of 5% on purchases.

The balance on the supplier's account at the end of the period is:

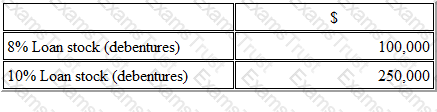

Refer to the exhibit.

A company has the following debt in the statement of financial position

The finance cost to be charged to the income statement is

The double entry system underpins all accounting records

Which of the following combinations represent debit balances?

Which of the following is the best definition of the objective of accounting?

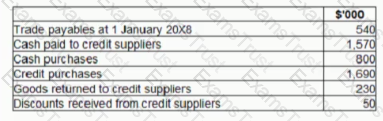

BCD has the following balances for the year ended 31 December 20X8:

What is the trade payables balance of BCD at 31 December 20X8? Give your answer to the nearest $"000.

Which one of the following internal controls is designed to prevent errors and fraud?

A company had a gross profit margin of 40%. Sales for the period were $280,000 and opening and closing inventories were $18,000 and $16,000 respectively.

Purchases for the period were therefore

In a cash flow statement, which one of the following would not be found under the section "cash flows from operating activities"?

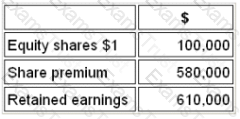

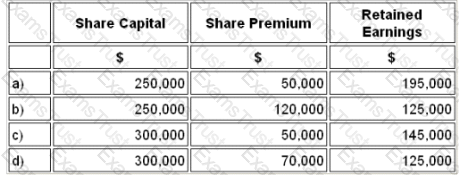

Refer to the exhibit.

A company has the following equity balances at the beginning of the year

During the year the company made a bonus issue of 1 for 4 shares

What are the equity balances after this issue?

The total of the debit column of a trial balance is $800 bigger than the credit column.

Which of the following is the entry recorded in the suspense account?

In a cash flow statement, which one of the following would not be found under the section "cash flows from financing activities"?

Which one of the following would not be classified as an efficiency ratio?

Which THREE of the following represent credit balances?

Which of the following best explains what is meant by "capital expenditure"?

Which of the following are possible reason for a credit balance on the sales ledger account of a customer?

(a) A contra entry between the sales ledger and the purchase ledger has been carried out for an amount in excess of the sales ledger balance

(b) A customer has returned goods subsequent to making payment for them

(c) A credit note has been issued in error

(d) A bad debt written off has subsequently been paid

Which TWO of the following are principles of the Integrated Reporting Framework?

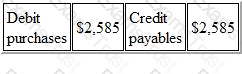

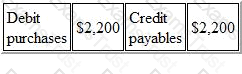

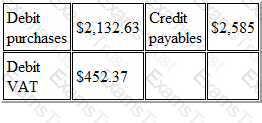

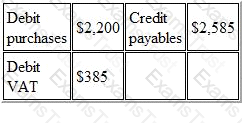

A company which is VAT-registered receives an invoice for goods purchased for resale totaling $2,585 from a supplier that is not VAT-registered. VAT is at the rate of 17.5%.

The correct entry to record the invoice is:

A)

B)

C)

D)

The purpose of the external audit is the examination of, and expression of opinion on the financial statements of an entity.

What is the purpose of internal audits?

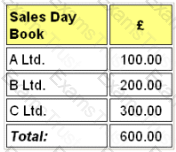

Refer to the Exhibit.

The sales day book for the last month, appeared as follows:

The entries which should be made in the ledger accounts are:

The answer is:

Jasper has an opening capital balance at 1 January of $84,650 credit. During the period there was an increase in assets of $16,890 and an increase in liabilities of $22,480.

The balance on the capital account at the end of the period is:

A business will maintain a non-current asset register to keep a record of all non-current assets held.

Which THREE of the following are examples of information contained within the register?

Which TWO of the following are responsibilities of the IFRS interpretations committee?

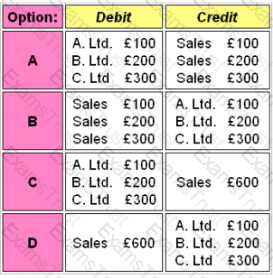

Refer to the Exhibit.

A company had previously written off one of their receivables that had been declared bankrupt. The administrators of the bankruptcy have now sent a cheque to the company for the full amount originally outstanding. The company now needs to record this receipt.

Which of the following is the correct double entry?

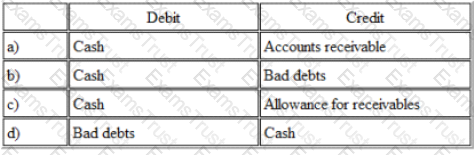

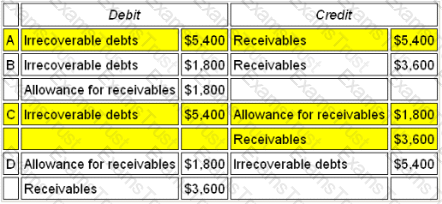

Refer to the Exhibit.

Ax minster Limited is calculating its irrecoverable debt charge and allowance for receivables for inclusion in its year-end accounts. The current allowance for receivables is $28,600 and it is estimated that this needs to be raised to $30,400. There are also bad debts of $3,600 which should be written off.

Which is the correct entry to be made to the accounts to record these transactions?

The correct entry to be made to the accounts to record these transactions is:

In accordance with IAS 7 Statements of Cash Flow, which TWO of the following are cash flows presented as investing activities?

Published accounts must include the following statements:

Which one of the following is an error of commission?

Refer to the Exhibit.

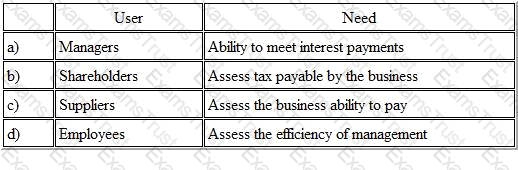

Accounting information is required for a wide range of users both internal and external. Each user has a different need for the information.

Which of the following is the correct combination of user and need?

Which THREE of the following are characteristics of financial accounting?

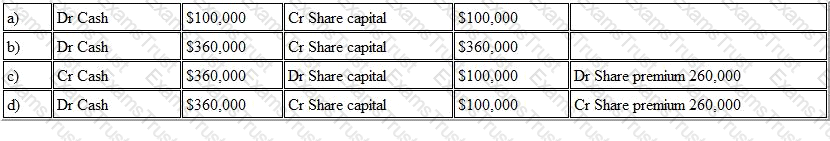

Refer to the exhibit.

ABC issued 200,000 $0.50 equity shares at a price of $1.80. This amount was received in cash

What is the correct journal to record this issue?

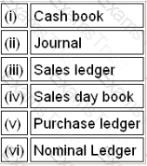

Refer to the Exhibit.

Which of the following are books of prime entry?

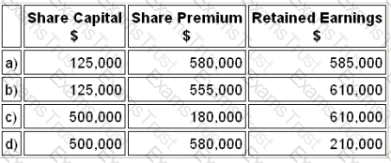

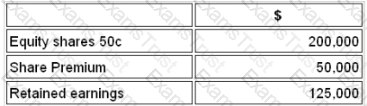

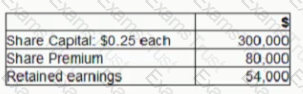

Refer to the exhibit.

A company has the following equity balances at the beginning of the year:

During the year the company issued 100,000 new shares at $1.20 each

What are the equity balances after this issue?

Which of the following transactions affects profit but does not affect cash?

DEF has the following equity balances at 1 June 20X7.

On 30 June 20X7 DEF issued 200.000 new shares at their full market price of $1 75.

What are the equity balances of DEF after issuing these shares?

A)

B)

C)

D)

Non-current assets can be divided between intangible and tangible assets.

Which THREE of the following are intangible assets?

A business may have thousands of transactions in any one accounting year. To trace the details of one of those transactions could be very difficult

Which of the following would be a way to make this easier?

The Subscriptions Receivable account of a club commenced the year with subscriptions in arrears of £250 and subscriptions in advance of £375.

During the year £62,250 was received in subscriptions, including £200 of the arrears, and £600 for next year's subscriptions. Subscriptions still owing at the end of the year amounted to £180.

The amount to be taken to the Income and Expenditure for the year is

The Finance Director of EFG company has made the following statements regarding the recording of expenditure relating to the entity's property, plant and equipment (PPE) in the nominal ledger.

Which THREE of the following statements are true?

External auditors report their findings to:

One of the main responsibilities of internal auditors is to check the operational systems within their organization to establish whether the system's internal controls are sufficient and in full operation.

Which THREE of the following are examples of internal controls?