A week later, Romuald Marek stops by your workspace and hands you a document.

The Board minute extract from Romuald can be viewed by clicking the Reference Material button above.

Reference Material

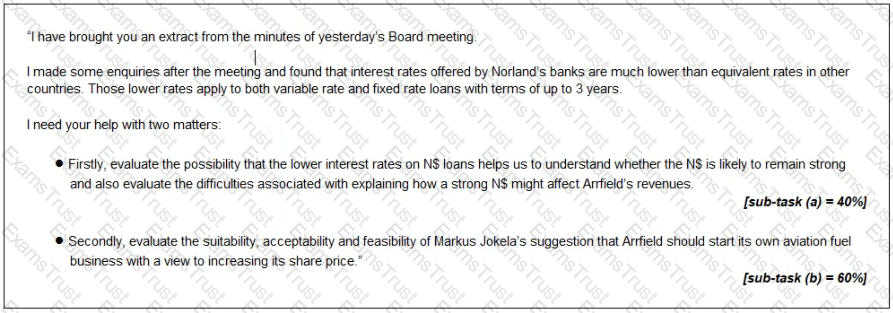

Board minutes extract: proposal to profit from ongoing strength of NS

Anna Obalowu Sole, Chief Operating Officer, reported that the strong NS was helping generate revenues from fuel sales. Discussion followed as to whether the strong N$ was likely to persist and whether a strong N$ benefits Arrfield overall.

Markus Jokela. Chief Executive Officer, stated that the Board should develop contingency plans that could be implemented if it seemed likely that the strong N$ would persist. In particular. Arrfield need not renew the contracts that permit aviation fuel suppliers to operate from its airports. Arrfield would then be free to create its own fuel sale business, buying fuel in bulk to replenish the storage tanks at each of its airports in Norland and then selling it directly to airlines He stated that this would almost certainly enhance Arrfield's share price

Romuald Marek reminded the Board that four of Arrfield's six airports are located in Norland and that those airports charge for aeronautical and non-aeronautical services in N$.

Hello

I have attached a news article

Arrfield does not set the price for aviation fuel sold at our airports, but we do receive a percentage of the revenues earned by the fuel companies.

I need your help to prepare for a Board meeting to discuss this matter Please write a paper covering the following

* Firstly, explain the impact that the criticisms voiced by the environmental campaigners will have on the frequent PESTEL analysis that Arrfield's Board conducts.

[sub-task (a) = 34%

* Secondly, evaluate the commercial logic of Arrfield's strategy of basing charges for non-aeronautical services (such as fuel sales and retail activities) on percentages of the revenues generated by the companies that operate at its airports

[sub-task (b) = 33%)

* Thirdly, recommend with reasons whether Arrfield should attempt to justify strategic decisions to its shareholders when the commercial logic of those decisions is not immediately obvious

[sub-task (c) = 33%}

Thanks

Romuald Marek

Chief Finance Officer

You have received the following email from Marcus Svenson, Finance Director:

From: Marcus Svenson, Finance Director

To: Senior Finance Manager

Subject: News reports

Hi,

I have sent you a link to a news site on the internet. Things are getting complicated in Bravador.

Every Board member has been asked to attend a brainstorming session this afternoon, before the CEO flies out to Bravador this evening. We will be considering the following four matters:

Is it acceptable for us to develop this forest, given the commitment that we have made with respect to indigenous peoples’ rights? They have been quoted at the end of the news article.

Is it fair for the environmental protestors to complain that our operations are unsustainable?

Would it be unethical to offer to build a village, with a proper school and medical clinic, for the tribe and to offer them work in our forestry operations?

Is it really a good idea for the CEO to fly to Bravador just to appear on the television news in his boots and overalls?

Please email me your thoughts on each of these matters before I leave for the meeting this afternoon.

Marcus

The formal merger with Darrell has been negotiated and the legal formalities have been completed. The two company management teams are working on the integration of the two businesses.

You receive an email from Peter Sorchi, the Chief Executive of the merged company:

From: Peter Sorchi, Chief Executive Officer

To: Senior Finance Manager

Subject: Integration of IT and treasury

Hi,

I need you to advise me on a couple of matters. The attached press clipping shows how sensitive this is.

We need to integrate the IT and treasury functions of the former Wodd and Darrell. I thought that it would be a simple matter of identifying the common ground and slimming down both companies’ departments to cover the new entity, but I have the heads of both IT and treasury from each company arguing that their approaches are better for the merged group and that they should take the lead.

Wodd’s Treasurer claims to be an expert in natural hedging of currency risks and Darrell’s argues that her department was highly successful because it makes excellent use of derivatives for hedging. Both agree only on the fact that they cannot work together. I am afraid that I have to agree with them on that and the Board will have the difficult decision of choosing between them.

I have the opposite problem with the IT function. The two Heads of IT are excited to be able to combine their databases and to develop their respective interests in Big Data. They claim that we should retain all of the professional staff in both departments and possibly even expand the merged IT Department beyond that. Given the rationalisation in all of our other functions, I do not think that we can agree to that, but I would hate to throw away a worthwhile opportunity.

Please give me your thoughts on the following:

What approach to hedging is more likely to meet our needs: natural hedging or heavy use of derivatives?

Ignoring hedging, what other factors should we consider in deciding between the two treasurers?

Are the two heads of IT likely to be correct in arguing that we need to retain all existing IT staff in order to exploit synergies in data, particularly opportunities to leverage Big Data?

What would the challenges be in motivating them to reduce their joint staffing levels and how might we deal with these?

Peter

From: Martin Wills, Head Geologist

To: William Seaton, Director of Finance

Subject: Reserves

Hi William,

I have reviewed the situation with respect to our “probable” or “2P” reserves, as disclosed in our latest annual report. I am sorry to say that we have to downgrade our figures with respect to reserves. I am recommending that all extraction activities cease for the foreseeable future on the North Atlantic and South Atlantic fields and that the proved reserves be downgraded from proved to probable.

I have to stress that this is not attributable to any past error on the part of the geologists. The world oil price has been depressed and the discovery of large deposits of shale oil in the USA suggests that the oil price will not recover for some time. That means that some oil wells that were commercially viable this time last year are no longer worth processing.

The oil remains under the rock and I have no doubt that we will restore operations in the long term.

We are by no means the only oil company to have been forced to take this action.

The one piece of good news is that the financial statements for the year ended 31 December 2014 have already been published. My understanding is that we do not have to withdraw them, so unless you put an advertisement in the press, we can carry on quietly trying to sort this mess out.

I have my best people working on ways to extract oil from our wells more efficiently, so we may be able to increase production over the next year or so.

Martin

From: Jan Archibald, Group Chief Financial Officer, Fouce Oil

To: William Seaton, Director of Finance

Subject: Sale of oil fields

Dear William,

As you know, the Board of Fouce Oil is keen that you should operate in an autonomous manner. However, we believe that it is our duty to ask you to reconsider a key issue in Slide’s approach to doing business.

Over the years you have been very successful indeed in finding significant oil fields and bringing those to production. We have been gratified to observe your efforts in doing so and we believe that all shareholders have benefitted from the wealth that you have created.

The Board of Fouce Oil believes that the time has come for Slide to stop giving the fruits of its labour away to other companies. We believe that Slide should retain any successful oil wells and start to earn revenues from the sale of the oil itself rather than the sale of the oil wells. We believe that the stock market would respond favourably to such a development, to the mutual benefit of all.

Best Wishes

Jan