CD has 200,000 equity shares with a current market value of $2.50 each. The annual dividend of $0.50 a share is about to be paid.

CD also has redeemable debt with a nominal value of $100,000. This is currently trading at $90 for each $100 of nominal value.

The cost of equity is 20% and the post tax cost of debt is 6%.

What is CD's weighted average cost of capital?

Give your answer in % to one decimal place.

? %

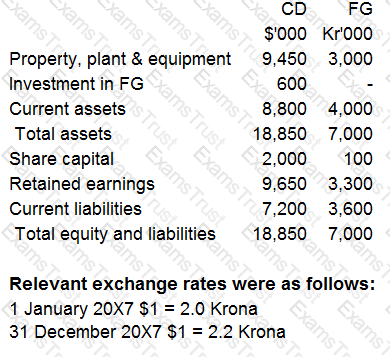

CD acquired 100% of the equity share capital of FG for cash consideration of Kr1,200,000 on 1 January 20X7.

Retained earnings of FG at the date of acquisition was Kr800,000. CD operates from Country A and its functional and presentation currency is $. FG is located and trades throughout Country B and its functional currency is the Krona (Kr).

CD has no other subsidiaries. Goodwill had not suffered any impairment to date.

Summarised data from the statements of financial position for both entities at 31 December 20X7 is presented below:

Calculate the exchange difference arising on the retranslation of goodwill on the acquisition in the consolidated statement of financial position of CD at 31 December 20X7.

Give your answer to the nearest $000.

If you were asked to express the overall performance of an entity as a percentage of its total investment in net assets which of the following ratios would you calculate?

MS Group's total profit for period on their consolidated income statement is £31,000. This includes adjusting for their share of joint venture JV2. Calculate the share of joint venture MS Group received based on the

following information.

MS operating profit £41,000

Dividend from JV2 £5,000

Finance cost £3,000

Tax £11,000

An investor owns 75 shares values at $1.50 each. If the shares increase in value to $1.75, how much money will the investor have made through this capital gain?

When consolidating for group accounts, a number of calculations and adjustments are required to properly combine the entities into a single group. Which of the following processes are involved in this consolidation

method?

Select ALL that apply:

RS has issued an instrument with a nominal value of $1 million, at a discount of 2.5%, and a coupon rate of 6%. The terms of the issue are that the instrument must either be redeemed at par, at the option of the holder, in three years' time, or alternatively converted into equity shares in RS.

The characteristics of this instrument taken as a whole indicates that it would be classifed as which of the following?

EF obtained a government licence, free of charge, to operate a silver mine in 20X7 and $5 million was spent on preparing the site. The mine commenced operation on 1 January 20X8. The licence requires that at the end of the mine's useful life of 20 years, the site above ground must be reinstated to its original position.

EF estimated that the cost in 20 years' time of this reinstatement will be $3 million, which has a present value of $1 million at 1 January 20X8.

Which THREE of the following describe how the cost of the reinstatement of the site should be treated in the financial statements of EF in the year ended 31 December 20X8?

GH issued a 6% debenture for $1,000,000 on 1 January 20X4. A broker fee of $50,000 was payable in respect of this issue. The effective interest rate associated with this debt instrument is 7.2%.

The carrying value of the debenture at 31 December 20X4 is:

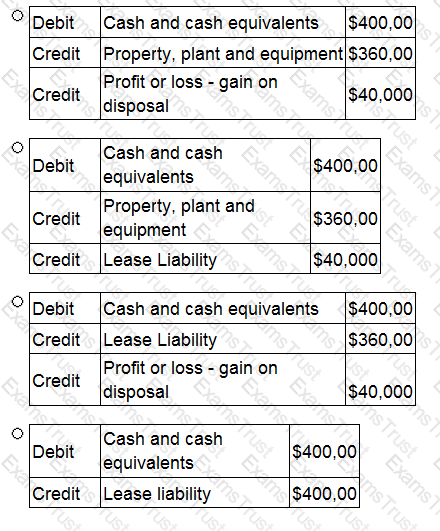

ST has sold its main office property, which had a carrying value of $360,000, to AB, a property management entity.

The property was sold for $400,000 which is equal to its fair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?

AB acquired 10% of the equity share capital of XY on 1 January 20X7 for $180,000 when the fair value of XY's net assets was $190,000. On 1 January 20X9 AB purchased a further 50% of the equity share capital for $550,000 when the fair value of XY's net assets was $820,000.

The original 10% investment had a fair value of $200,000 at the date control of XY was gained. The non controlling interest in XY was measured at its fair value of $300,000 at 1 January 20X9.

Which of the following represents the correct value of goodwill arising on the acquisition of XY that would have been included by AB when it prepared its consolidated financial statements at 31 December 20X9?

LM are just about to pay a dividend of 20 cents a share. Historically, dividends have grown at a rate of 5% each year.

The current share price is $3.05.

The cost of equity using the dividend valuation model is:

ST acquired 70% of the equity shares of DE for $87,500 on 30 September 20X5. At the date of acquisition the net assets of DE were $54,700 and the fair value of the non controlling interest was measured at $19,700. There has been no impairment of goodwill.

On 30 September 20X9 ST disposed of its entire investment in DE for $262,500 when the net assets of DE were $96,250.

What is the gain or loss on disposal of DE that will be included in ST's consolidated profit or loss for the year ended 30 September 20X9?

Mr. Rodgers is an accountant for JK Pic. He is asked to record a particular share-based payment in the company's accounts and obliges by debiting as an expense the first relevant account and crediting the

corresponding double-entry as a liability.

Which type of share-based payment has Mr. Rodgers recorded?

An entity undertakes an issue of new debt which has the effect of reducing the entity's weighted average cost of capital (WACC).

Which of the following would best explain why the WACC will have fallen?

JJ's current share price is $1.80, with a dividend of $0.20 a share just about to be paid.

Dividends have increased at an average annual growth rate of 4.5% and this is expected to continue into the future.

What is JJ's cost of equity?

ST acquired two financial investments in the year to 31 December 20X8. One of these investments was initially classified as held for trading, the other as available for sale. ST remeasured both investments at fair value at 31 December 20X8 in accordance with IAS 39 Financial Instruments: Recognition and Measurement. The resulting gains were calculated as follows:

• Gain on held for trading investment $50,000

• Gain on available for sale investment $40,000

What was the value of the gain that ST presented in its other comprehensive income when it prepared its financial statements for the year to 31 December 20X8?

Give your answer to the nearest $000.

$ ? 000

The IAS definitions of financial instruments dictate their classification between debt and equity. Which of of the following factors might this classification impact?

Select ALL that apply.

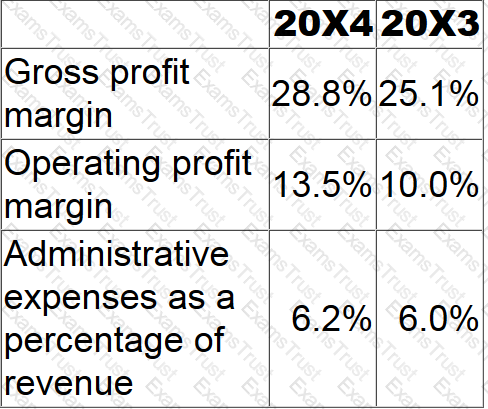

PQ is a retail business. In recent years they have improved their financial performance and increased their revenue. The following ratios have been calculated for the years ended 31 December 20X4 and 20X3:

Which of the following explanations of PQ's financial performance is consistent with these ratios?

ST has sold its main office property, which had a carrying value of $360,000, to AB, a property management entity.

The property was sold for $400,000 which is equal to its fair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

UV entered into a five year non-cancellable operating lease for an asset two years ago. Lease payments are settled annually in arrears.

At the year end, UV no longer requires this leased asset as they have decided to discontinue the product line that it was used for.

At this date UV had made two out of the five lease payments.

Which of the following statements about the unavoidable lease payments is true in accordance with IAS 37 Provisions, Contingent Liabilities and Assets?

On 1 January 20X1 KL acquired 75% of the equity shares of PQ. Goodwill arising on the acquisition was $480,000. On 31 December 20X3 KL sold the full investment of PQ to XY Group for $2,000,000. On this date the net assets of PQ were $1,340,000 and the non-controlling interests stood at $410,000.

What is the gain on disposal to be recognised in the consolidated statement of profit or loss of KL?

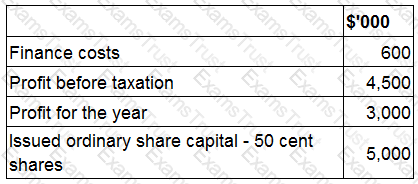

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

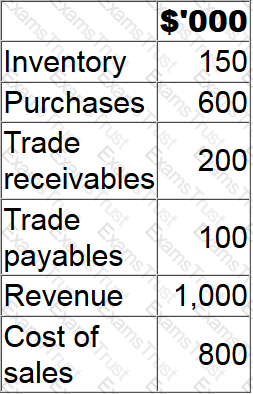

The following information has been extracted from the financial records of DEF for the year ended 31 December 20X2.

What is the operating cycle of DEF at 31 December 20X1?

Assume there are 365 days in the year.

All workings should be rounded to whole days.

Give your answer in whole days.

? days.

The tax benefit on a company's asset is £180,000 and the useful life on that asset is five years. The company creates a deferred tax provision to spread this benefit over the asset's useful life.

What entry is needed to reduce this deferred tax provision in the company's year two accounts?

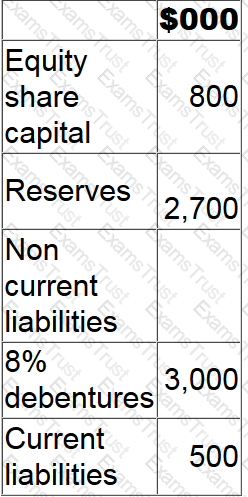

F has profit before interest and tax of $400,000 for the year to 30 June 20X4.

Extracts from F's statement of financial position at 30 June 20X4 are as follows:

Calculate the gearing (debt:equity) ratio at 30 June 20X4.

Give your answer to the nearest whole percentage.

? %

AB's financial information shows that the non current assets' carrying value is greater than the tax base at the year end.

What is the journal entry to record the movement in the provision for deferred tax resulting from this difference?

Which of the following statements is true in respect of ST's gross profit margin based on the information given?

RST sells computer equipment and prepares its financial statements to 31 December.

On 30 September 20X5 RST sold computer software along with a two year maintenance package to a customer. The customer is given the right to return the goods within six months and claim a full refund if they are not satisfied with the computer software. The risk of return is considered to be insignificant for RST.

How should the revenue from this transaction and the right of return be recognised in the financial statements for the year ended 31 December 20X5?

Calculate the value of non controlling interest that will be presented in KL's consolidated statement of financial position at 31 December 20X9?

Give your answer to the nearest whole $'000.

$ ? 000

XY purchased $100,000 of quoted 8% bonds in the current year which it intends to hold until redemption.

Which of the following identifies the correct classification and subsequent measurement basis for this financial instrument?

How would KL account for its investment in MN in its consolidated financial statements for the year to 31 December 20X9?

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

LM has made the following share purchases during the year:

• Purchased 55% of the equity share capital of OP.

• Purchased 45% of the equity share capital of QR. LM have the power to appoint the majority of board members on the QR board.

• Purchased 30% of the equity share capital of ST. LM is represented by one director on the main board of ST which has five members in total. The other 70% of ST's equity share capital is owned by a single company, UV.

The Managing Director has told you that OP has performed well, but both QR and ST have not performed as expected. He is therefore pleased that OP will be included as a subsidiary and that QR and ST will only be included as investments in the group financial statements.

In accordance with the ethical principle of professional competence and due care how should the investments in OP, QR and ST be treated in the group financial statements?

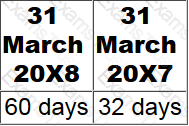

JK has calculated its inventory holding period:

Which THREE of the following would have contributed to the above movement in inventory holding period?

Which of the following defines the calculation of interest cover?

Which of the following is a related party according to the definition of a related party in IAS24 Related Party Disclosures?

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

AB and FG incorporated on 1 January 20X1 in the same country and had similar investment in net assets. Both entities are financed entirely by equity. In the year to 31 December 20X1 both entities generated the same volume of sales.

Which of the following, taken individually, would explain why AB's return on capital employed ratio was lower than that of FG?