Which THREE of the following statements relating to fixed overhead variances are correct?

The term ‘budgetary slack’ refers to the:

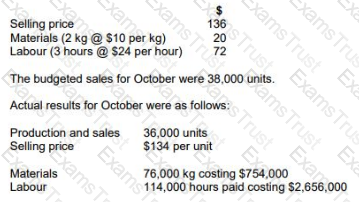

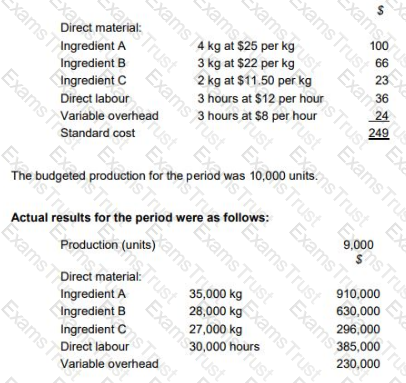

GH manufactures a product using skilled labour and high quality materials. The company operates a standard costing system and a just-in-time (JIT) purchasing and production system. The standard selling price and variable costs for one unit of the product are as follows:

Prepare a statement that reconciles the budgeted contribution with the actual contribution for October. Your statement should show the variances in as much detail as possible.

What was the actual contribution for October?

Which THREE of the following are advantages of activity-based costing (ABC), in a multi-product environment, when compared with traditional absorption costing?

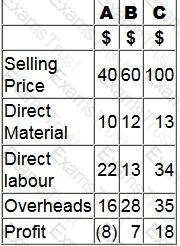

A company makes and sells three products A, B and C.

The selling prices and costs of the three products, using a traditional absoprtion costing system, are shown in the table below.

The company has undertaken an analysis of overhead costs using activity-based costing (ABC).

The revised overhead costs for products A, B and C are $6, $32 and $55 respectively.

When comparing the figures obtained under the two costing methods, which of the following statements are true?

Select ALL that apply.

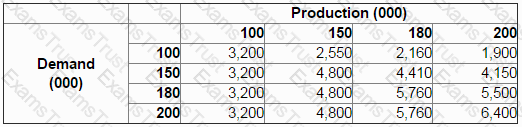

A company is launching a new product.

The company accountant has constructed a payoff table to show the estimated profit at different levels of production and demand.

How many units should the company produce if the minimax regret criterion is applied?

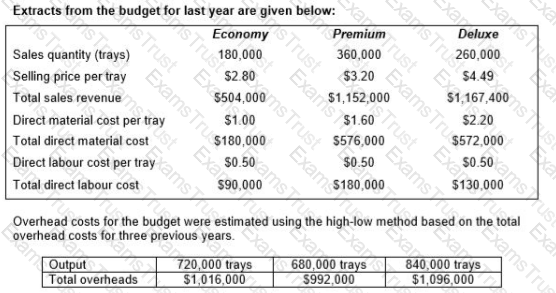

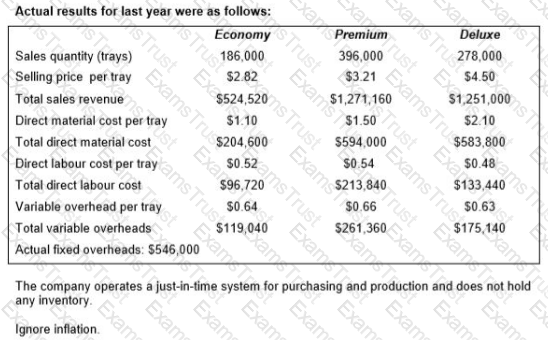

A company produces trays of pre-prepared meals that are sold to restaurants and food retailers. Three varieties of meals are sold: economy, premium and deluxe.

Calculate, for the original budget, the budgeted fixed overhead costs, the budgeted variable overhead cost per tray and the budgeted total overheads costs.

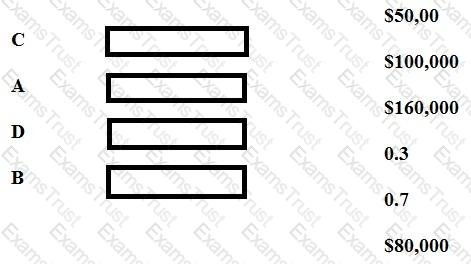

A company is forecasting its revenue for May and has established that sales will be either high, medium or low. The expected value of sales revenue for May has been calculated as $160,000. The following table includes data which relate to the potential sales in May.

Revenue Probability Expected Value

High $250,000 0.2 C

Medium A 0.5 D

Low $100,000 B $30,000

Place the figures given in to the spaces marked with the letters A, B, C and D, to complete the above table.

Company NBO is providing a quote to manufacture 500 passenger seats for a bus company.

Relevant cost is being used as the basis for the quote.

Which THREE of the following should be included as relevant costs or savings in the production of the 500 passenger seats?

A company has a budgeted contribution to sales (C/S) ratio of 30% and a budgeted operating profit margin of 20%. Budgeted sales were $100,000.

In month 2, actual production and sales volumes and all costs were as budgeted. The actual C/S ratio was 33% .

Which of the following statements, about the company's contribution and operating profit in month 2, is correct?

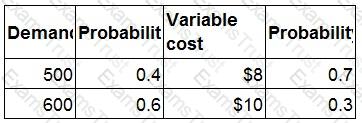

A company is launching a new product with a selling price of $20.

Demand and variable cost are both uncertain and possible demand levels and variable costs are given below:

Outcomes for demand and variable cost are independent.

What is the expected contribution from the product?

Give your answer as a whole number.

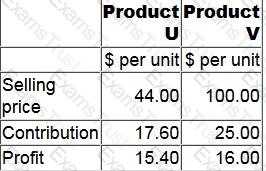

Information about a company's only two products is as follows:

The revenue from the products must be in the constant mix of 2U:3V. Budgeted monthly sales revenue is $110,000.

Fixed costs are $23,095 each month.

To the nearest $10, what is the budgeted monthly margin of safety in terms of sales revenue?

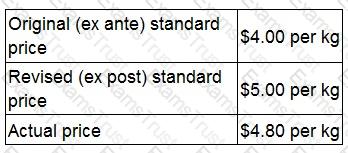

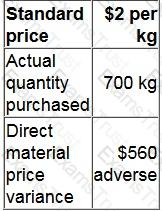

A company reports planning and operational variances to its managers. The following data are available concerning the price of direct material M in the last period. Material M is the only material used by the company. The company operates a just-in-time (JIT) purchasing system.

Which TWO of the following statements about last period are definitely correct based on this information?

The direct material price operational variance was adverse.

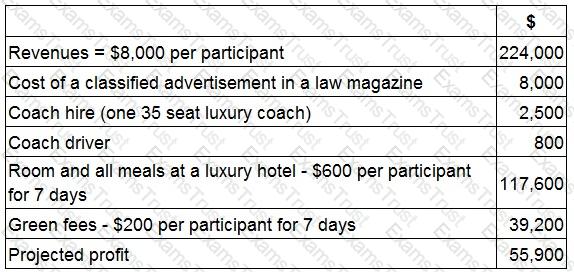

JKI is planning a golfing holiday for a group of wealthy lawyers.

The lawyers will fly to the local airport at their own expense. JKI will then pay for transport, accommodation and the use of the golf course (green fees).

JKI's costings are as follows, based on 28 participants:

JKI received 46 applications from potential participants.

What would the profit be if JKI accepted all of these bookings?

Give your answer to the nearest whole number.

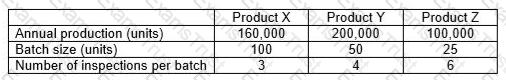

A company uses an activity based costing system. The company manufactures three products, details of which are given below:

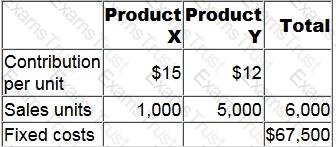

A company sells two products, X and Y, which are always sold in the same ratio.

No inventories are held.

The following budgeted data relate to month 10:

What is the budgeted margin of safety in month 10?

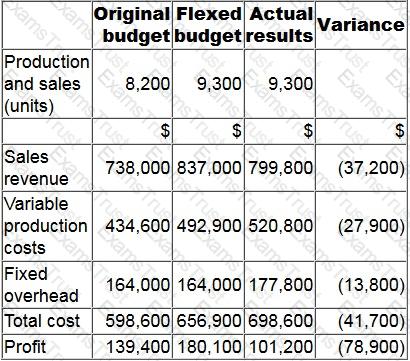

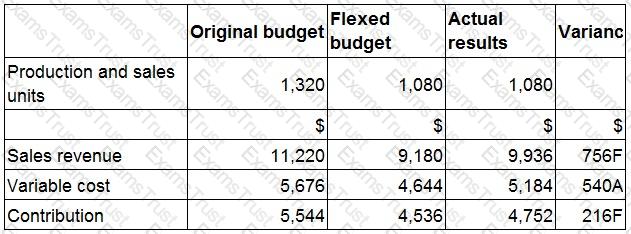

The budgetary control report of XYZ for the latest period is shown below. Variances in brackets are adverse.

What is the sales volume profit variance?

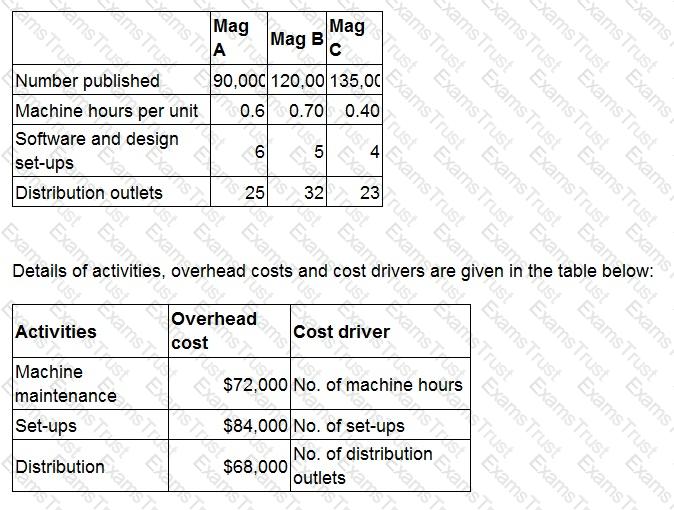

TDM edits, prints and publishes three magazines, Mag A, Mag B and Mag C. The company operates an activity-based costing system.

The following information has been obtained.

What is the overhead cost attributable for each Mag A publication?

Give your answer to the nearest whole cent.

A company manufactures two products and has two production constraints.

When the graphical approach to linear programming is used, the axes of the graph will show:

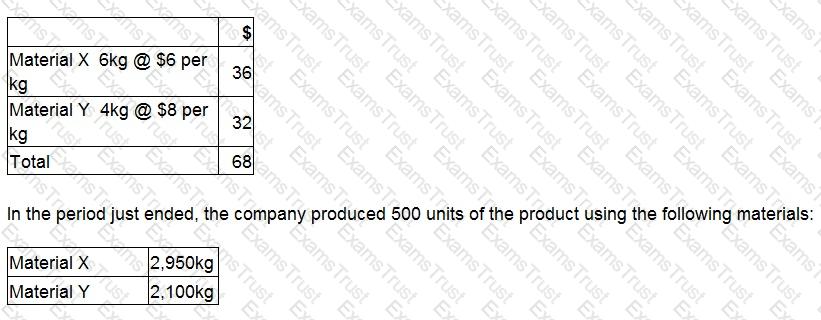

A company makes a product using two materials, X and Y.

The standard materials required for one unit of the product are:

What is the direct material mix variance for Material X, using the individual valuation basis?

A company is basing its budget on predicted sales of one of its products. They have tasked you with forecasting the sales in year 2. The company has found that a fairly accurate prediction can be found when the trend

is calculated like so:

a = 10,000

b = 2,000

The sales of year 1 were affected by seasonal variation and were as follows:

Q1:12,500

Q2:14,200

Q3:15,400

Q4:19,650

You use a multiplicative model and round percentages to the nearest whole percent.

Select ALL the correct quarterly forecasts of year 2 from the list.

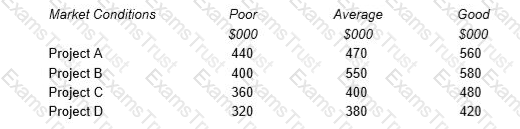

XY can choose from four mutually exclusive projects. The projects will each last for one year and their net cash inflows will be determined by market conditions. The forecast net cash inflows for each of the possible outcomes are shown below.

If the company applies the maximin criterion the project chosen would be:

State whether the following costs are relevant or non-relevant in the context of short-term decision making scenarios.

N prepares budgets on an annual basis by using the budget from the previous year, and then adjusting it for growth and inflation.

This is an example of:

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers’ specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

Discuss the usefulness of the planning and operational variances calculated for TP’s management.

Select ALL the TRUE statements.

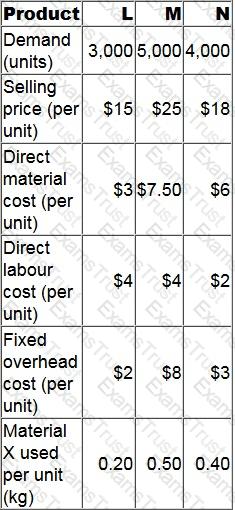

FG Enterprises manufactures and sells three products. There are 4,400 kg of Material X available in the next period. Material X is used in the manufacture of all three products. The following data is available for the next period.

What is the optimal production plan for the next period in order to maximise profit?

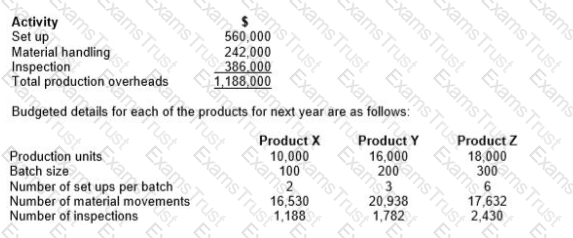

EF manufactures and sells three products, X, Y and Z. The following production overhead costs are budgeted for next year:

Required:

Calculate the total budgeted production overhead cost for each product using activity based budgeting.

Your company want to know how many units they'd have to sell this season to break even. However, you have some reservations over whether or not breakeven analysis is suitable for the company.

Which of these assumptions over product range limit the accuracy of break even analysis? Select ALL that apply.

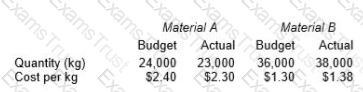

A company produces a product that requires two materials, Material A and Material B. Details of the material quantities and costs for August are given in the table below.

Budgeted and actual output of the product for August was 12,000 units.

The material mix variance for August is:

Product G has the following sales information:

If moving averages of annual sales over 3-year periods are calculated, what is the moving average at Year 3?

A company has budgeted to produce 5,000 units of Product B per month. The opening and closing inventories of Product B for next month are budgeted to be 400 units and 900 units respectively. The budgeted selling price and variable production costs per unit for Product B are as follows:

Total budgeted fixed production overheads are $29,500 per month.

The company absorbs fixed production overheads on the basis of the budgeted number of units produced. The budgeted profit for Product B for next month, using absorption costing, is $20,700.

Prepare a marginal costing statement which shows the budgeted profit for Product B for next month.

What was the marginal costing profit for the next month?

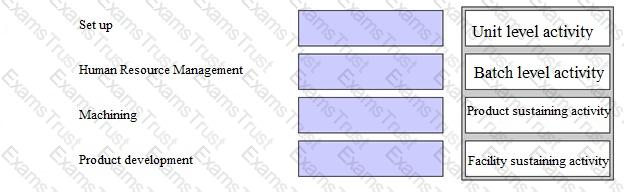

Place each activity against the correct category according to its classification in the cost hierarchy of activities.

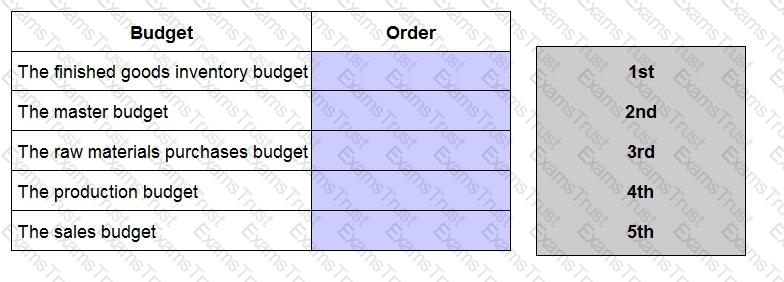

Rank the budgets listed below to show the order in which they should normally be prepared:

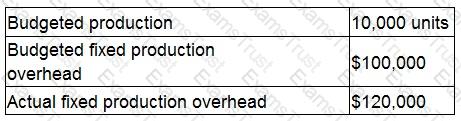

A company manufactures a single product. The company absorbs fixed production overhead using a pre-determined rate per unit.

The following data applies for month 7:

During month 7 fixed production overhead was over absorbed by $40,000.

What was the actual number of units produced during month 7?

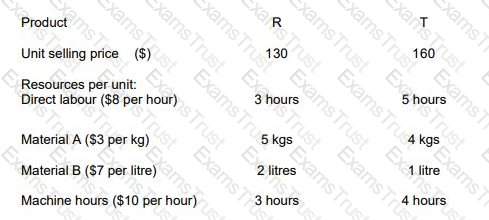

RT produces two products from different quantities of the same resources using a just-in-time (JIT) production system. The selling price and resource requirements of each of the products are shown below:

Market research shows that the maximum demand for products R and T during June 2010 is 500 units and 800 units respectively. This does not include an order that RT has agreed with a commercial customer for the supply of 250 units of R and 350 units of T at selling prices of $100 and $135 per unit respectively. Although the customer will accept part of the order, failure by RT to deliver the order in full by the end of June will cause RT to incur a $10,000 financial penalty. At a recent meeting of the purchasing and production managers to discuss the production plans of RT for June, the following resource restrictions for June were identified: Direct labour hours 7,500 hours

Material A 8,500 kgs

Material B 3,000 litres

Machine hours 7,500 hours

(Refer to previous 2 questions.)

You have now presented your optimum production plan to the purchasing and production managers of RT. During your presentation it became clear that the predicted resource restrictions were rather optimistic. In fact, the managers agreed that the availability of all of the resources could be as much as 10% lower than their original predictions.

Assuming that RT completes the order with the commercial customer, and using linear programming, show the optimum production plan for RT for June 2010 on the basis that the availability of all resources is 10% lower than originally predicted.

A budgetary control report for the latest period is shown below:

Which TWO of the following statements are correct?

Which of the following distinguishes risk from uncertainty?

The following information is available about direct material T for the last period.

A JIT purchasing system is in operation.

Calculate the actual price paid per kg of material T.

Give your answer to 2 decimal places.

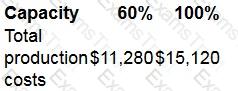

A manufacturing company has a capacity of 10,000 units. The flexed production cost budget of the company is as follows:

All costs are either fixed, variable or semi-variable.

What is the budgeted total production cost if the company operates at 85% capacity?