Which of the following correctly defines the expected value of a project?

A very large organization is financed by both debt and equity. It evaluates all projects on the basis of their net present value (NPV) using an organization wide weighted average cost of capital as the discount rate.

For a small project, which TWO of the following would affect the project's cash flows AND the discount rate?

If transfer prices are set at variable costs, the supplying division does not cover its fixed costs.

Which of the following does NOT resolve this problem?

SDF is a newly-established production company that is experiencing high staff turnover in its factory. The production department is studying the manufacturing process and its associated learning curve.

Which of the following statements is correct?

A positive net present value (NPV) has been calculated for a project to launch a new product. An additional calculation is required to identify the sensitivity of the NPV to changes in the forecast total sales volume.

The present value of which of the following would be used in the calculation?

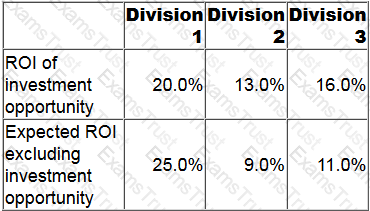

A company has three divisions, each of which is an investment centre. The divisional managers' performance is assessed using return on investment (ROI). A higher ROI will result in a higher bonus for the divisional manager.

The company's cost of capital is 15%.

For the forthcoming year each divisional manager has one investment opportunity available as follows:

The manager(s) of which division(s) will proceed with their respective investment opportunity?

Company D is about to launch an innovative and unique product which may face direct competition within three years. The company needs to achieve a rapid payback on all investments because it has limited access to external finance.

Which is the most appropriate pricing strategy for company D's new product, and for what reason?

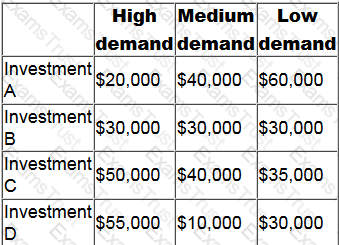

A company is considering four mutually exclusive projects. There are three possible future demand conditions but the company has no idea of the probability of each of these demand conditions occurring. The forecast net present values (NPVs) of each of the four projects, under each of the three possible future demand conditions, are as follows.

Which investment would be selected using the maximin criterion?

Endure Co. makes 1,000 units ofX and 2,000 units of Y.

Costs for X: Material $4, labour $8, direct overhead $2, fixed cost $4.

Costs for Y: Material $9, labour $9, direct overhead $4, fixed cost $6.

Selling price for X and Y are S19 and $25 respectively. Another company can sell ready made product X and product Y's to Endure Co, this company sells X at $12 and Y at $21. Advise Endure Co. on what would be the

most cost effective way to source products X and Y.

An organization wishes to make its investment decisions on the basis of more than simply a financial appraisal. Which of the following will assist it to take into account both qualitative and quantitative factors?

Which of the following is the ideal basis to use for a transfer price when there is a perfect external market?

An organization has the right to mine for gold on its land. The price of gold and the cost of extraction are such that mining is not currently financially viable. However, the organization has the right to commence mining at any time in the future if the price of gold increases and makes mining financially viable.

This right to commence mining in the future is an option to:

An airline prides itself on using highly reliable aircraft that are maintained to the highest possible standard and that its flight crews are arguably the best in the industry. Despite that, the directors accept that there remains a slight possibility that there will be a fatal accident.

Which THREE of the following statements are correct?

An organization's transfer pricing system involves:

• The transferring division receiving $20 per unit; an amount equal to its variable costs.

• The receiving division paying an additional $30,000 every month to the transferring division.

Which transfer pricing system is the organization using?

Company TTM has the opportunity to invest $60,000 in a project. The project is anticipated to produce annual returns of $12,500 each year for 8 years. The cost of capital is 12%.

What is the net present value of the project? Give your answer to the nearest whole number.

One aspect of life cycle costing is the recognition of the fact that during the design or development stage a large proportion of many products' life cycle costs are:

Which of the following statements is TRUE about the activity based costing system when compared to absorption costing method?

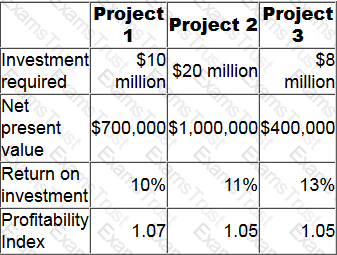

A company has a cost of capital of 12% and a maximum of $20 million to invest. It has identified three possible investment projects, none of which is divisible, as follows.

Which project(s) should the company invest in?

A not-for-profit organization measures performance using the three Es. If the organization has made optimum utilization of available resources then it should be described as:

An organization wishes to achieve cost reductions for a product it already has in production without affecting the customer's perception of the product.

It has decided to carry out a systematic examination of the factors affecting the cost of the product in order to identify ways of achieving the specified purpose at lower cost while maintaining the required standard and quality.

Which of the following correctly identifies the activity that the organization is undertaking?

A supermarket group has experienced operational problems during recent years, including a shortage of warehousing space due to increasing turnover and poor inventory management. The product portfolio has expanded considerably. Although this has led to increased sales volume, marketing and logistics costs have increased disproportionately. Non product-specific costs have also increased significantly.

Management is now considering using Direct Product Profitability (DPP).

Which of the following statements are valid in respect of the possible implementation of DPP within the supermarket group?

Select ALL that apply.

Company B, a video games developer, wants to use data to track the amount of traffic it receives on its social media pages. It specifically wants to find out the demographic it is most popular with on this platform, and

how it can branch out to different demographics through further advertising.

How best could the company use big data to expand its demographic reach?

Select ALL that apply.

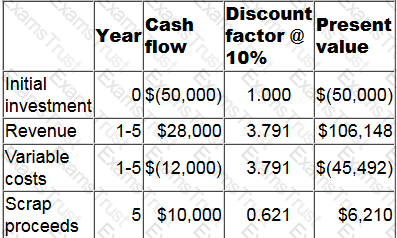

The following data relate to an investment opportunity.

The percentage reduction in the annual revenue that could occur before the project is no longer financially viable is:

A long established organization has recognised the need to make urgent changes to the way it operates in order to remain competitive. The organization wishes to dramatically improve its performance through a fundamental rethinking and radical redesign of its existing activities.

Which of the following techniques should be used to achieve this?

A company is investing $150,000 in a project which will yield an annual cash inflow of $40,000 for eight years. The company's cost of capital is 10%.

To the nearest $100, what is the project's equivalent annual net present value?

It is often claimed that a two-part transfer pricing system offers a number of advantages to organizations which use it.

Which of the following statements is NOT an advantage of using a two-part transfer pricing system?

Juan is looking to invest in the mining industry. He has narrowed his options down to two rival companies, both with sales of £200m. Company A has an EBIT of £10m whereas Company B has an EBIT of £14m.

This would suggest that Company B is the better investment but Juan is suspicious that Company B has more financial backing than Company A.

Which ratios will tell him which company will use his investment the best?

An 80% learning curve will apply to the production of a new product. The first unit will require 120 labor hours. The labor rate is $11 per hour.

To the nearest $1, the expected total labor cost for the first 4 units is:

A company operates a divisional structure. The manager of division D receives a bonus based on the division's annual return on capital employed (ROCE).

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus.

The manager is considering an investment in a new machine for next year. The incremental ROCE earned by the machine is expected to be 19% although the ROCE for the division as a whole with the machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%.

The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?

Which of the following statements is correct in respect of the key feature of dual pricing?