An engagement supervisor reviewed a staff internal auditor's documentation and noted that several edits should be made. The internal audit activity uses an electronic workpaper database and does not maintain paper files for its system of record. A system error prevents the engagement supervisor from adding her electronic signature to any workpaper in the database Given this situation which is the most appropriate response to provide evidence of supervisory review?

An organization's finance manager plans to implement a state-of-the-art management system to better manage the organization's receivables. The finance manager consulted the chief audit executive (CAE) and asked for her assistance in determining whether the organization is able to accommodate this system. How would the CAE proceed to determine the objectives of this engagement

An internal auditor was assigned to review controls in the accounts payable function. Most of tie accounts payable processes are performed by a third-party service provider. The auditor included in the audit report a number of control deficiencies involving processes performed by the service provider. The service provider requested a copy of the report Which of Vie following would be the most appropriate response from the chief audit executive (CAE)?

An internal audit activity plans its engagements based on an organization-wide risk assessment. According to IIA guidance, which of the following statements is true regarding the required frequency of the risk assessment?

It is close to the fiscal year end for a government agency, and the chief audit executive (CAE) has the following items to submit to either the board or the chief executive officer (CEO) for approval. According to IIA guidance, which of the following items should be submitted only to the CEO?

'Internal policy prohibits employees from entering into contacts with financial obligations without proper approval.

A project manager signed a change to an important service agreement without obtaining the proper approval As a result the organization is receiving $5,000 per month less for its services.’’

Which of the following should be added to the observation?

The chief audit executive of an international organization is planning an audit of the treasury function located at the organization's headquarters. The current internal audit team at headquarters lacks expertise in the area of financial markets which is needed tor the engagement When of the following would be the most approbate solution considering the time constraint?

Which of the following is the primary weakness of internal control questionnaires (ICQs)?

According to IIA guidance, which of the following statements are true regarding the internal audit plan?

1. The audit plan is based on an assessment of risks to the organization.

2. The audit plan is designed to determine the effectiveness of the organization's risk management process.

3. The audit plan is developed by senior management of the organization.

4. The audit plan is aligned with the organization's goals.

An internal auditor was reviewing the procurement department's tender documentation for completeness He documented all discrepancies but the procurement manager disagreed with his findings Upon further review, the internal auditor noted that all discrepancies had been corrected in the tender database. Which of the following courses of action would have prevented this situation?

To effectively communicate the acceptance of risk in an organization a chief audit executive must first consider which of the following?

Which of the following sources of audit evidence is most reliable?

In a health care organization the internal audit activity provides overall assurance on governance, risk and control The chief audit executive advises and influences senior management, and the audit strategy leverages the organization's management of risk According to HA guidance which of the following stages of internal audit maturity best describes this organization?

A draft internal audit report that cites deficient conditions generally should be reviewed with which of the following groups?

1. The client manager and her superior.

2. Anyone who may object to the report’s validity.

3. Anyone required to take action.

4. The same individuals who receive the final report.

An examination of the accounts payable function evidenced multiple findings with respect to segregation of duties. After management's response and action plan are received and documented in the final report, which of the following is most appropriate?

Which of the following internal audit activities is performed in the design evaluation phase?

Which of the following actives is an internal auditor most likely to perform when establishing the objectives of an assurance engagement?

Which of the following statements is true regarding internal auditors and other assurance providers?

A chief audit executive (CAE) determined that management chose to accept a high-level risk that may be unacceptable lo the organization. Which is the best course of action for the CAE to Follow?

An internal auditor and engagement client are deadlocked over the auditor's differing opinion with management on the adequacy of access controls for a major system. Which of the following strategies would be the most helpful in resolving this dispute?

Following an audit, management developed an action plan to improve controls over the handling of scrap metal. Which of the following would be the most appropriate course of action for the auditor to follow up?

An internal auditor at a bank informed the branch manager of a malfunctioning lock on one of the vaults. The risk associated with this issue was deemed significant by the chief audit executive (CAE), and immediate remediation was recommended However during a follow-up engagement the branch manager told the CAE that the risk was actually not significant, hence no action was taken. What is the most appropriate next step for the CAE?

An internal audit manager is planning a contract compliance audit Which of the following should be done prior to developing the audit work program?

According to IIA guidance, which of the following actions might place the independence of the internal audit function in jeopardy?

The audit manager asked the internal auditor to perform additional testing because several irregularities were found in the financial information. Which of the following would be the most appropriate analytical review for the auditor to perform?

An audit observation states the following:

"Despite the rules of the organization there is no approved credit risk management policy in the subsidiary. The subsidiary is concluding contacts with clients who have very high credit ratings. The internal audit team tested 50 contacts and 17 showed clients with a poor credit history"

Which of the following components are missing in the observation?

Which of the following statements is true regarding internal controls?

An internal auditor s testing tor proper authorization of contracts and finds that the rate of deviations discovered in the sample is equal to the tolerable deviation rate. When of the following is the most appropriate conclusion for the internal auditor to make based on this result?

Senior management is challenging regulatory fines that were assessed to the organization due to questionable business practices. Their actions and the fines could have an adverse effect on the organization's ability to continue business. How would the chief audit executive respond?

A chief audit executive is preparing interview questions for the upcoming recruitment of a senior internal auditor. According to IIA guidance, which of the following attributes shows a candidate's ability to probe further when reviewing incidents that have the appearance of misbehavior?

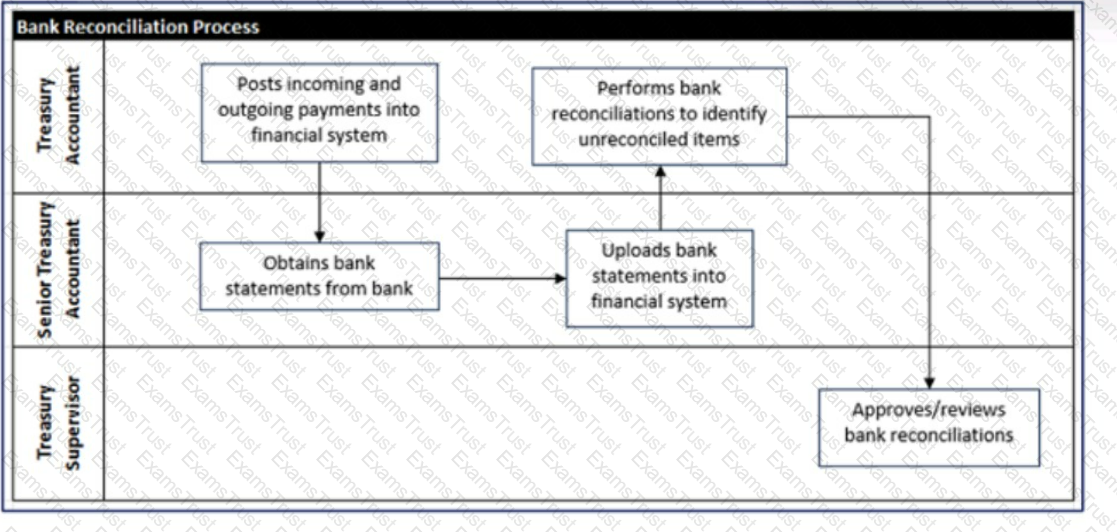

Below is a flowchart detailing an organization's bank reconciliation process. Which of the following conclusions can be drawn from the flowchart?

An internal auditor is planning an engagement at a financial institution. Toe engagement objective is to identify whether loans were granted in accordance with the organization's policies. When of the following approaches would provide the auditor with the best information?

According to IIA guidance, which of the following would not be a consideration for the internal audit activity (IAA) when determining the need to follow-up on recommendations?

According to IIA guidance, which of the following statements is true regarding the authority of the chief audit executive (CAE) to release previous audit reports to outside parties?

During an assurance engagement, an internal auditor discovered that a sales manager approved numerous sales contracts for values exceeding his authorization limit. The auditor reported the finding to the audit supervisor, noting that the sales manager had additional new contracts under negotiation. According to IIA guidance, which of the following would be the most appropriate next step?

A newly appointed chief audit executive (CAE) of a small organization is developing a resource management plan Which of the following approaches would be most beneficial to help the CAE obtain details of the Internal audit activity's collective knowledge skills, and other competencies?

According to IIA guidance, which of the following is most likely to become part of the engagement work program?

Which of the following statements concerning workpapers is the most accurate?

The newly appointed chief audit executive (CAE) of a large multinational corporation, with seasoned internal audit departments located around the world, is reviewing responsibilities for engagement reports. According to IIA guidance, which of the following statements is true?

While performing fieldwork for an assurance engagement, a member of the internal audit team identified a key control that was not identified during the planning phase of the engagement Which of the following actions by the internal auditor would be most appropriate?

An internal auditor is conducting a review of the procurement function and uncovers a potential conflict of interest between the chief operating officer and a significant supplier of IT software development services. Which of the following actions is most appropriate for the internal auditor to take?

When estimating the impact of an inherent risk, which of the following should internal auditors consider?

Which of the following actions is the most appropriate response for an internal auditor to take when a significant risk is identified during a consulting engagement?

Which of the following is an example of a properly supervised engagement?

Which of the following statements regarding the risk management process' support of the internal audit activity is true?

Which of the following represents the best method for confirming that vendor invoices were for authorized purchases?

Which of the following reasonably represents best practices regarding what should be the level of internal audit resource investment in monitoring and following up on engagement outcomes?

An internal auditor examined a nostatistical sample of open accounts receivable balances and discovered that 10 out of 60 exceeded the approved unseated credit limit threshold defined by the organization's policy What should the auditor document in the workpapers?

An IT auditor is reviewing the access controls in an organization's accounting application. The auditor intends to deploy a tool that can help test the logical controls embedded in the system to ensure employee access is granted according to need. Which of the following would help achieve this objective?

An internal auditor discovered that sales contracts with business clients were not stored in the electronic document management database instead they were scanned and saved in a nonsystematic manner to server folders Which of the following would be an appropriate consequence for the internal auditor to include in the documented observation?

Which of the following manual audit approaches describes testing the validity of a document by following it backward to a previously prepared record?

What is the primary reason that audit supervision includes approval of the engagement report?

According to IIA guidance, which of the following is a limitation of a heat map?

A healthcare organization's chief audit executive (CAE) noted that the organization's IT team relies heavily on a vendor. Therefore an IT vendor assessment review was added to the annual audit plan. During the review, the audit team discovered that the vendor had not been performing proper monitoring to ensure that the subcontractors it hired comply with the organization requirements. The organization's chief information officer (ClO) does not agree with the audit team's recommendation for the IT team to monitor the compliance level of vendor subcontractors. How should the audit team proceed to resolve this situation?

Which of the following engagement supervision activities should be performed first?

Which of the following is an appropriate documentation of proper engagement supervision?

According to IIA guidance, which of the following would be considered necessary for a one-person audit function?

To which of the following aspects should the chief audit executive give the most consideration while communicating an identified unacceptable risk to management?

How should an internal auditor approach preparing a detailed risk assessment during engagement planning?

Which of the following offers the best explanation of why the auditor in charge would assign a junior auditor to complete a complex part of the audit engagement?

An internal auditor is conducting a preliminary survey of the investments area, and sends an internal control questionnaire to the management of the function. (An extract of the survey is provided below).

1. Are there any restrictions for any company's investments?

2. Are there any written policies and procedures that document the flow of investment processing?

3. Are investment purchases recorded in the general ledger on the date traded?

4. Is the documentation easily accessible to an persons who need in to perform their job?

Which of the following is a drawback of testing methods like this?

According to IIA guidance which of the following statements is true regarding heat maps?

A bakery chain has a statistical model that can be used to predict daily sales at individual stores based on a direct relationship to the cost of ingredients used and an inverse relationship to rainy days. What conditions would an auditor look for as an indicator of employee theft of food from a specific store?

A team of internal auditors is assigned to audit the employee relations process in an organization, which includes employee conduct and disciplinary hearings. Which of the following audit approaches would provide the auditors with the best evidence to determine the degree to which disciplinary decisions are complying with documented policy?

According to IIA guidance which of the following best describes reliable information?

The chief audit executive (CAE) is developing a workpaper preparation policy for a new internal audit activity. The CAE wants to ensure that all workpapers relate directly to the engagement objectives. Which of the following statements should be included in the policy specifically to address this concern?

An internal auditor is using computer-assisted audit techniques to examine employee expenses across several divisions of the organization. Which of the following is true in this situation?

While conducting a review of the logistics department the internal audit team identified a crucial control weakness. The chief audit executive (CAE) decided to prepare an audit memorandum for management of the logistics department followed by an informal meeting What is the most likely reason the CAE decided to prepare the audit memorandum?

When constructing a staffing schedule for the internal audit activity (IAA), which of the following criteria are most important for the chief audit executive to consider for the effective use of audit resources?

1. The competency and qualifications of the audit staff for specific assignments.

2. The effectiveness of IAA staff performance measures.

3. The number of training hours received by staff auditors compared to the budget.

4. The geographical dispersion of audit staff across the organization.

Due to emerging new technologies that greatly affect the organization, the chief audit executive (CAE) wants to conduct frequent IT audit and is particularly focused on improving the quality of these engagements. Which of the following is the most viable solution for the CAE to ensure that IT audit quality is immediately enhanced and maintained long-term?

According to IIA guidance, which of the following are appropriate actions for the chief audit executive regarding management's response to audit recommendations?

Which of the following is one of the differences between probability-proportional-to-size (PPS) and attribute sampling?

Which of the following best describes how an internal auditor would use a flowchart during engagement planning?

An internal auditor is analyzing sates records and is concerned whether a transaction is recorded in the coned period. The accounting manager explains that the external auditor approved the records and produces an email from the external audit team leader. How should tie internal auditor respond?

Which of the following behaviors could represent a significant ethical risk if exhibited by an organization's board?

1. Intervening during an audit involving ethical wrongdoing.

2. Discussing periodic reports of ethical breaches.

3. Authorizing an investigation of an unsafe product.

4. Negotiating a settlement of an employee claim for personal damages.

Which of the following audit steps would an internal auditor perform when reviewing cash disbursements to satisfy IIA guidance on due professional care?

An organization buys crude oil on the open market and refines it into a high-quality gasoline. The price of crude oil is extremely volatile. Which of the following is the most appropriate risk management technique to protect the organization against these price fluctuations?

Which of the following best describes the four components of a balanced scorecard?

An internal auditor receives a document displaying all the steps of a process and the path taken as transactions flow between each step of the process How is the internal auditor most likely to use This document during the engagement?

Which of the following should the chief audit executive do when evaluating the possibility of relying on external auditors' work?

Which of the following should management action plans include at a minimum?

Considering the five-attribute approach to documenting deficiencies in an area under review which of the following answers the question. "What should be in place?’’

A toy manufacturer receives certain components from an overseas supplier and uses them to assemble final products Recently quality reviews have identified numerous issues regarding the components' compliance with mandatory quality standards. Which type of engagement would be most appropriate to assess the root causes of the quality issues?

An internal auditor is planning to audit the organization's payroll function, which was recently outsourced. Which of the following is the most appropriate first step for the auditor?

The internal audit activity is currently working on several engagements, including a consulting engagement on the management process in the human resources department. Which of the following actions should the chief audit executive take to most efficiently and effectively ensure the quality of the engagement?

After the team member who specialized in fraud investigations left the internal audit team, the chief audit executive decided to outsource fraud investigations to a third party service provider on an as needed basis. Which of the following is most likely to be a disadvantage of this outsourcing decision?

During a fraud interview, it was discovered that unquestioned authority enabled a vice president to steal funds from the organization. Which of the following best describes this condition?

Which of the following is not a primary purpose for conducting a walk-through during the initial stages of an assurance engagement?

Which of the following is the primary reason the chief audit executive should consider the organization's strategic plans when developing the annual audit plan?

White planning an audit engagement of a procurement card activity. which of the following actions should an internal auditor take to denary relevant risks and controls?

Which of the following statements is true regarding the use of internal control questionnaires (ICOs)?

An internal auditor is preparing for an auditor of newly implemented software that is used by 3,000 employees in South America and Europe. What would be the best way for the auditor to gather relevant feedback?

When setting the scope for the identification and assessment of key risks and controls in a process, which of the following would be the least appropriate approach?

In an organization with a large internal audit activity that has several audit teams performing engagements simultaneously which of the following tasks is an engagement supervisor most likely to perform during the planning phase of a new engagement?

Which of the following statements accurately describes the Standards requirement for ret internal audit records?

The internal auditor and her supervisor are in dispute about a risk that was not tested during an audit of the procurement function. Which of the following tools would best support the auditor's decision not to test the risk?

An internal auditor is examining the organization's internal control processes. Which of the following would the auditor do to test the reliability of a customer database1?

Which of the following would be the most reliable source of documentary evidence?

Which of the following statements is true regarding the final assurance engagement report issued to management?

An internal auditor has been asked to join a project team to help design controls in a software application to address specific risks that have been identified by the team Which of the following actions is most appropriate for the internal auditor to perform?

When auditing an organization's cash-handling activates which of the following is the most reliable form of testimonial evidence an internal auditor can obtain?

When me internal audit activity does not have sufficient time to complete its usual root cause analysis which c4 the following is most appropriate?

Which of the following would not be a typical activity for the chief audit executive to perform following an audit engagement?

Management has taken immediate action to address an observation received during an audit of the organization's manufacturing process Which of the following is true regarding the validity of the observation closure?

Which of the following actions best describes an internal auditor's use of test data to determine whether an organization's new accounts payable system avoids processing questionable invoices for payment?

Which of the following factors should be considered when determining the staff requirements for an audit engagement?

The internal audit activity's time constraints.

The nature and complexity of the area to be audited.

The period of time since the area was last audited.

The auditors’ preference to audit the area.

The results of a preliminary risk assessment of the activity under review.

Which of the following is a primary reason for an internal auditor to use a risk and control questionnaire when auditing financial processes?

An internal audit intends to create a risk and control matrix to better understand the organization's complex manufacturing process. With which of the following approaches would the auditor most likely start?

An internal auditor develops an engagement observation related to an organization's accumulation of large travel advances. The auditor observes that the organization's procedures do not require justification for travel advances greater than a specific amount Which of the following best describes the organization's procedures?

During a review of the treasury function an internal auditor identified a risk that all bank accounts may net to include in the daily reconciliation process.

Which of the following responses would be most effective to mitigate this risk?

Which method of examining entity-level controls involves gathering information from work groups that represent different levels in an organization?

An internal auditor discovered a control weakness that needs to be communicated to management. Which of the following is the best method for first communicating the weakness?

During audit engagement planning, an internal auditor is determining the best approach for leveraging computer-assisted audit techniques (CAATs). Which of the following approaches maximizes the use of CAATs and why?

Which of the following is one of the five basic tnanoal statement assertions when an internal auditor evaluates controls over financial reporting?

The internal audit manager has been delegated the task of preparing the annual internal audit plan for the forthcoming fiscal year All engagements should be appropriately categorized and presented to the chief audit executive for review Which of the following would most likely be classified as a consulting engagement?

Which of the following statements about assurance maps is correct?

Which of the following describes the primary objective of an internal audit engagement supervisor?

In order to obtain background information on an assigned audit of data center operations an internal auditor administers control questionnaires to select individuals who have primary responsibilities within the process. Which of the following is a drawback of this approach?

What is the purpose of an internal control questionnaire?

During an engagement in one of the subsidiaries of an organization, an internal auditor noted the following in the workpapers:

"As a subsidiary of a multinational organization in this particular country, the entity is required to register annually with the

respective ministry. However, the subsidiary did not submit the required documentation for registration during the prior year. Failure

to comply with internal and external regulations could lead to penalties or fines from the respective authorities. It is recommended

that the management of the subsidiary ensures compliance with the relevant legislation. As a recoverable action, management

should register the subsidiary in the current year as soon as possible."

What part of this narrative represents a condition of the observation made by auditors in the final report?

After concluding a preliminary assessment, the engagement supervisor prepared a draft work program According to HA guidance which of the following would be tested by this program?

A code of business conduct should include which of the following to increase its deterrent effect?

1. Appropriate descriptions of penalties for misconduct.

2. A notification that code of conduct violations may lead to criminal prosecution.

3. A description of violations that injure the interests of the employer.

4. A list of employees covered by the code of conduct.

During an assurance engagement, an internal auditor noted that the time staff spent accessing customer information in large Excel spreadsheets could be reduced significantly through the use of macros. The auditor would like to train staff on how to use the macros. Which of the following is the most appropriate course of action for the internal auditor to take?

An internal auditor is asked to determine why the production line for a large manufacturing organization has been experiencing shutdowns due to unavailable pacts The auditor learns that production data used for generating automatic purchases via electronic interchange is collected on personal computers connected by a local area network (LAN) Purchases are made from authorized vendors based on both the production plans for the next month and an authorized materials requirements plan (MRP) that identifies the parts needed per unit of production The auditor suspects the shutdowns are occurring because purchasing requirements have not been updated for changes in production techniques. Which of the following audit procedures should be used to test the auditor's theory?

Which of the following is an effective approach for internal auditors to take to improve collaboration with audit clients during an engagement?

1. Obtain control concerns from the client before the audit begins so the internal auditor can tailor the scope accordingly.

2. Discuss the engagement plan with the client so the client can understand the reasoning behind the approach.

3. Review test criteria and procedures where the client expresses concerns about the type of tests to be conducted.

4. Provide all observations at the end of the audit to ensure the client is in agreement with the facts before publishing the report.

An internal audit manager assigns an audit team to test purchase transactions by selecting a sample from transactions processed by each of the three procurement officers.

Which of the following techniques will help the audit team achieve this sampling objective?

An internal auditor wanted to determine whether company vehicles were being used for personal purposes She extracted a report that listed company vehicle numbers business units to which the vehicles are allocated travel dates, travel duration and mileage She then filtered the data for weekend dates Which of the following additional information would the auditor need?

An internal auditor collected several employee testimonials Which of the following is the best action for the internal auditor to take before drawing a conclusion?

While conducting an information security audit, an internal auditor learns that the existing disaster recovery plan is four years old and untested. The auditor also learns that in the four years since the recovery plan was implemented, the information systems have undergone extensive changes. Which of the following actions is most appropriate for the auditor to take?

An internal auditor determines that certain information from the engagement results is not appropriate for disclosure to all report recipients because it is privileged. In this situation, which of the following actions would be most appropriate?

When forming an opinion on the adequacy of management's systems of internal control, which of the following findings would provide the most reliable assurance to the chief audit executive?

• During an audit of the hiring process in a law firm, it was discovered that potential employees' credentials were not always confirmed sufficiently. This process remained unchanged at the following audit.

• During an audit of the accounts payable department, auditors calculated that two percent of accounts were paid past due. This condition persisted at a follow up audit.

• During an audit of the vehicle fleet of a rental agency, it was determined that at any given time, eight percent of the vehicles were not operational. During the next audit, this figure had increased.

• During an audit of the cash handling process in a casino, internal audit discovered control deficiencies in the transfer process between the slot machines and the cash counting area. It was corrected immediately.

Which of the following recommendations made by the internal audit activity (IAA) is most likely to help prevent fraud?

Some lime after the final audit report was issued, the engagement supervisor teamed that several internal control deficiencies were not remedied, despite management's previous agreement to remedy them According to IIA guidance, which of the following is the most appropriate response'5

According to IIA guidance, which of the following statements is true regarding engagement planning?

During an audit of the accounts receivable (AR) process, an internal auditor noted that reconciliations are still not performed regularly by the AR staff, a recommendation that was made following a previous audit. Monitoring by the financial reporting function has failed to detect the shortcoming. Both the financial reporting function and AR report to the controller, who is responsible for implementing action plans. Which of the following supports the internal auditor's decision to combine both observations into one reported finding?

The chief risk officer (CRO) of a large manufacturing organization decided to facilitate a workshop for process managers and staff to identify opportunities for improving productivity and reducing defects. Which of the following is the most likely reason the CRO chose the workshop approach?

Which of the followings statements describes a best practice regarding assurance engagement communication activities?

According to IIA guidance, organizations have the most influence on which element of fraud?

A chief audit executive's report to the board showed a significant trend of recent aud4s going over planned budgeted hours. Which of the following factors could cause this trend?

Which of the following approaches to understanding business processes is conducted from a broad organizational perspective and has the greatest risk of overlooking processes that are ultimately critical?

An engagement work program o of greatest value to audit management when which of the following is true?

The chief audit executive was asked to define me internal audit activity s key performance indicators (KPIs) tor the upcoming year. The KPIs must measure efficiency and effectiveness. Which of the following is an example of a KPI that measures effectiveness?

According to IIA guidance which of the following statements is true regarding the annual audit plan?