Using the two delivered Oracle Transactional Business Intelligence (OTBI) subject areas for Revenue Management, which two reporting objects can users build In the BI catalog?

Given It Is critical to capture common link values In one or more attributes on the source document lines in order to build effective Performance Obligation Identification Rules, how many User Extensible Fields does Revenue Management provide to facilitate the capture of this data?

In Revenue Management the Selling Amount and Allocated Amount may be different. How does Revenue Management account for this difference?

Which setup component Is NOT connected to a Revenue Price Profile?

A business entity (your client) sells a computer, monitor, keyboard, and mouse as a single package to consumers. The entity has identified that this bundle is a distinct performance obligation. How should you configure

Revenue management to ensure that these items are grouped into one performance obligation?

Which two are incorrect statements about the Oracle Fusion Receivables Transaction Sources section in the Manage Revenue Management System Options page?

Your organization Is selling a warranty plan to customers that covers appliances for one year. Revenue must be recognized gradually by month until the warranty expires.

Which Revenue Scheduling Rule Type needs to be defined for the Performance Satisfaction Plan?

When deciding how to set up the system to recognize revenue, it is important to understand the extent of revenue deferral and the subsequent timing of revenue recognition. Which two statements are true when you

consider that recognition depends on the nature of the contingency? (Choose two)

Which is NOT a predefined Accounting Class for Revenue Management?

A corporation does not have reliable historical Standalone Selling Prices stored In Its source systems. What option is available to help the corporation in this scenario?

In order to have Revenue Management calculate Observed Standalone Selling Prices, four steps must be completed.

Which two areNOTincluded in the four step process?

If the Contract Identification Rules that you defined for your customer did not group the source data into customer as expected, how would you resolve the issue?

Revenue tracks several amounts associated to a customer contract, for example, selling amount, allocated amount, and billed amount. What is allocated amount?

Which is Not a required piece of information when importing contract header information from a source file?

Which isNOTa required piece of information when importing contract header Information from a source file?

Which statement is NOT applicable to Performance Obligation Templates?

Which two are choices for the Satisfaction Method when defining a Performance Obligation Identification Rule?

A Corporation has a business requirement to build a custom Revenue Management report that users could run from the Scheduled Processes page.

Which reporting tool must be used to address this business requirement?

Which three tasks are associated with defining a Pricing Dimension Structure?

Revenue Management creates journal entries from a contract In order to recognize revenue properly. Which three event types are used by Revenue Management to create these journal entries?

Which three statements describe how Revenue Management creates accounting contracts to meet the new ASC 606 / IFRS 15 revenue recognition standards?

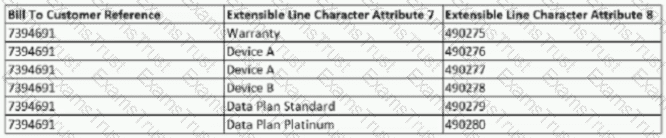

You define a Performance Obligation Identification Rule that uses the following matching attribute to group source document lines:

Extensible Line Character Attribute 7

Based on the data displayed:

How many performance obligations will be created In Revenue Management?

A corporation uses a primary ledger with a currency of USD. The organization's data includes source document lines with amounts expressed in the Euro currency. However, Revenue Management calculates transaction totals, allocations, and creates accounting in the ledger currency.

Which two options are available In Revenue Management to convert transaction amounts to the USD currency?

65-A business entity (your client) sells a computer, monitor, keyboard, and mouse as a single package to consumers. The entity has identified that this bundle is a distinct performance obligation. How would you

configure the Performance Obligation Identification Rule to ensure correct grouping of these items?