What can be assigned to a report item in a reporting rule?

Note: There are 2 correct answers to this question.

Your consolidation monitor is missing the group share calculation task. How could you correct the issue?

Note: There are 2 correct answers to this question.

What are the prerequisites for a horizontal merger?

Note: There are 2 correct answers to this question.

What field values are controlled by breakdown categories when posting to SAP S$/4HANA Finance for group reporting?

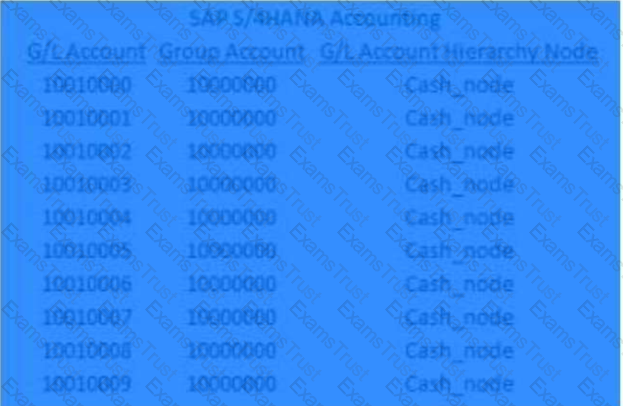

In SAP S/4HANA you have ten cash G/L accounts that belong to one G/L account hierarchy node and one group account as shown in the following table.

What is the recommended way to summarize the cash accounts into SAP S/4HANA Finance for group reporting?

When there is a balance sheet and income statement posting in a group journal entry, what creates the offsetting entries?

From which SAP S/4HANA tables can SAP Intercompany Matching and Reconciliation access intercompany data?

Note: There are 2 correct answers to this question.

The balance sheet in SAP S/4HANA Finance for group reporting is out of balance. When data validation is run, what is the result?

Where do non-historic currency translation adjustments normally post?Note: There are 2 correct answers to this question.

What does a reconciliation case in SAP Intercompany Matching and Reconciliation do?

What must be configured in order to release plan data into SAP S/4HANA Finance for group reporting?

In group reporting, what do SAP Intercompany Matching and Reconciliation reason codes do?